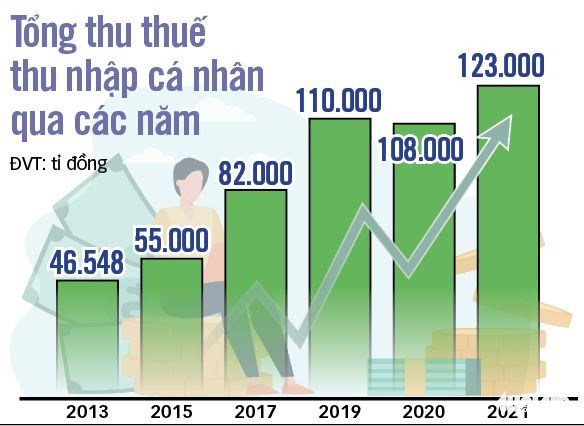

The Ministry of Finance is gathering feedback on proposed changes to the Personal Income Tax Law. Experts have suggested raising the taxable income to VND 15-20 million, lowering the highest tax rate to 25-30 percent, simplifying the tax schedule from 7 to 3 or 4 levels, adjusting the tax rate paid by year, and so…

The Law on Personal Income Tax during the implementation process has revealed many shortcomings, such as the reduction of family circumstances which is too low compared to spending levels, many tax levels and high taxes compared to income. Therefore, experts have made many proposals, including raising the deduction for family circumstances to 20 million dong….

In order to reduce personal income tax (PIT), salaried employees have brought many suggestions to increase the deduction and lower the tax rate this year. Gasoline prices have increased six times during the past two months, pushing up prices of vegetables, eggs, and meat. Moreover, the outbreak of the COVID-19 pandemic made the income and…

The Ministry of Finance’s proposed tax on houses and land has raised many citizens’ concerns. Experts said that it is necessary to avoid affecting the opportunity to access housing for middle- and low-income people in urban areas. If housing taxation is not be calculated conscientiously, many experts believe that this can create opposite effects, causing…

Personal income tax is a very special type of tax in Vietnam. This tax is mostly ignored by the entire population of Vietnam as they are not subject to it. Rather, it is only the rich class in society that has a headache over it. So, what are the notes on personal income tax in…

When doing real estate business, in addition to the fact that real estate must meet certain conditions, the business owner must establish a business and post-project information. However, there are still cases where the real estate business is not required to establish a company (enterprise). When is the real estate business not required to establish…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)