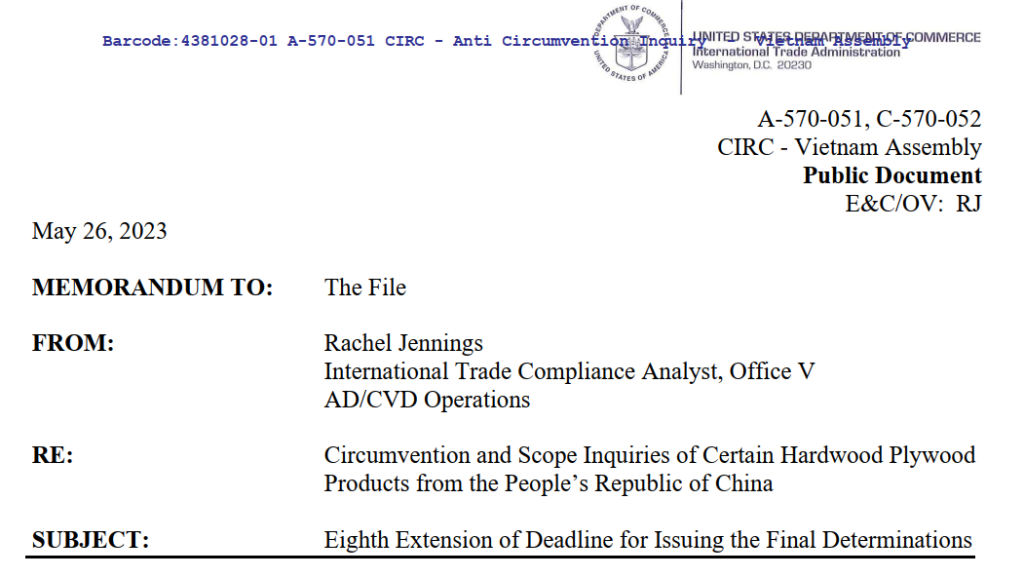

On May 26, 2023, the ITA, the United States Department of Commerce, issued notice A-570-051, C-570-052 code 4381028-01 on the eighth extension of the deadline to issue the final conclusion on the investigation of circumvention of trade remedies for hardwood plywood products imported from Vietnam. In June 2020, the US Department of Commerce announced the…

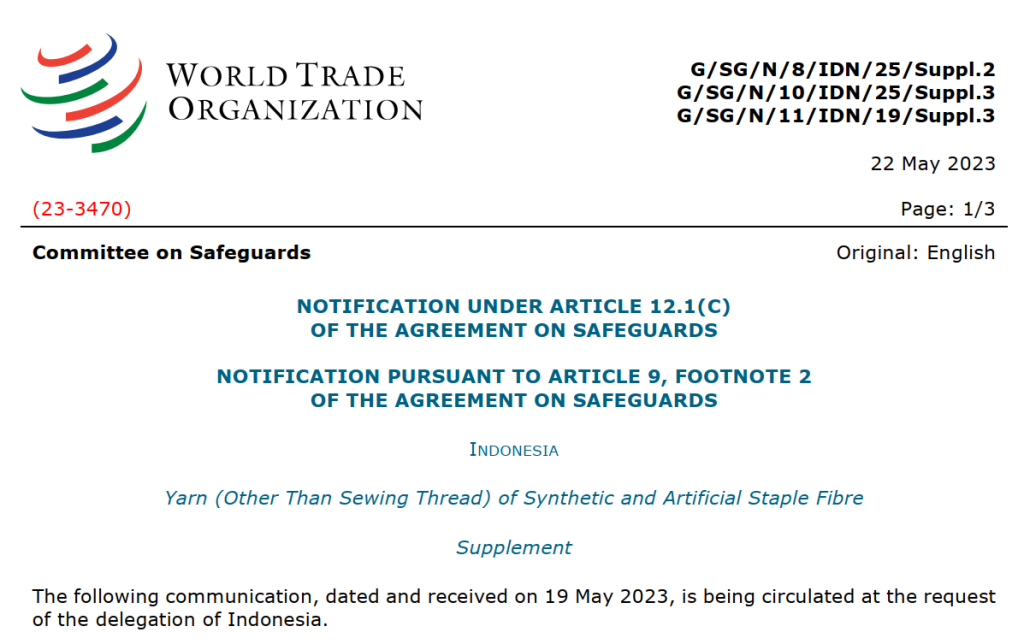

On May 22, 2023, the WTO issued an official notice of the review conclusions in the safeguard cases against a number of curtain and yarn products imported into Indonesia at the request of the Indonesian delegation on May 19, 2023. The notice includes two separate cases, the curtain safeguard case and the yarn safeguard case….

On May 24, 2023, after being vetoed by the President of the United States of America 1 week earlier, the United States House of Representatives held a re-vote on the Congressional Resolution related to the termination of the duty exemption order for solar panels products imported from 4 Southeast Asian countries including Vietnam. The remaining…

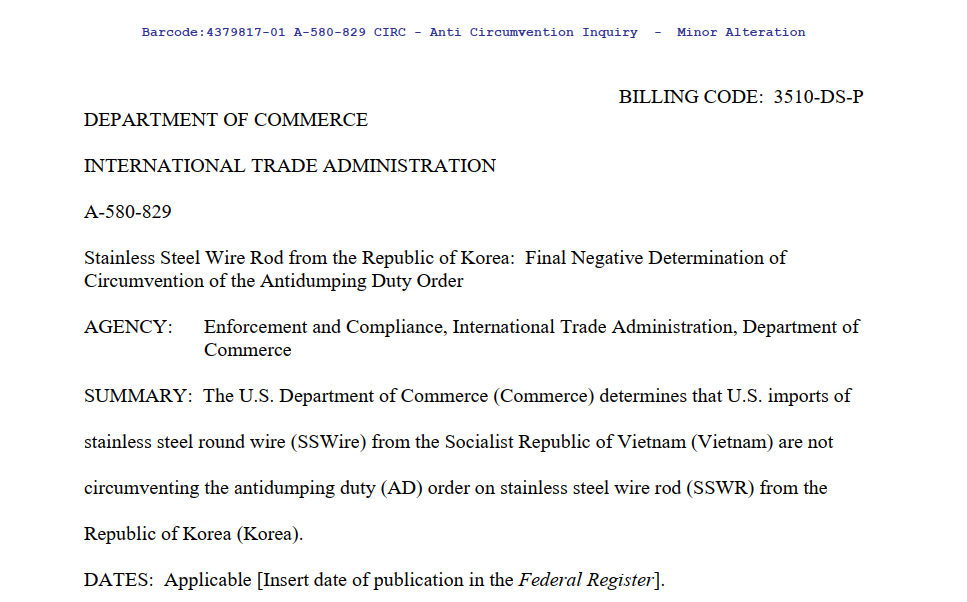

On May 22, 2023, the US Department of Commerce issued the final conclusion in the investigation of circumvention of anti-dumping duty with round stainless steel wire rod imported from Vietnam. According to the information of the DOC, Vietnamese enterprises did not implement the above anti-dumping duty circumvention. Originating from the US order to impose anti-dumping…

Recently, the Vietnamese Government has submitted to the National Assembly to reduce the value-added tax of 2%, except for telecommunications, real estate, securities, insurance, and banking products. The report submitted to the National Assembly by the Government of Vietnam on May 24, 2023 stated that the reduction of 2% value-added tax will be implemented in…

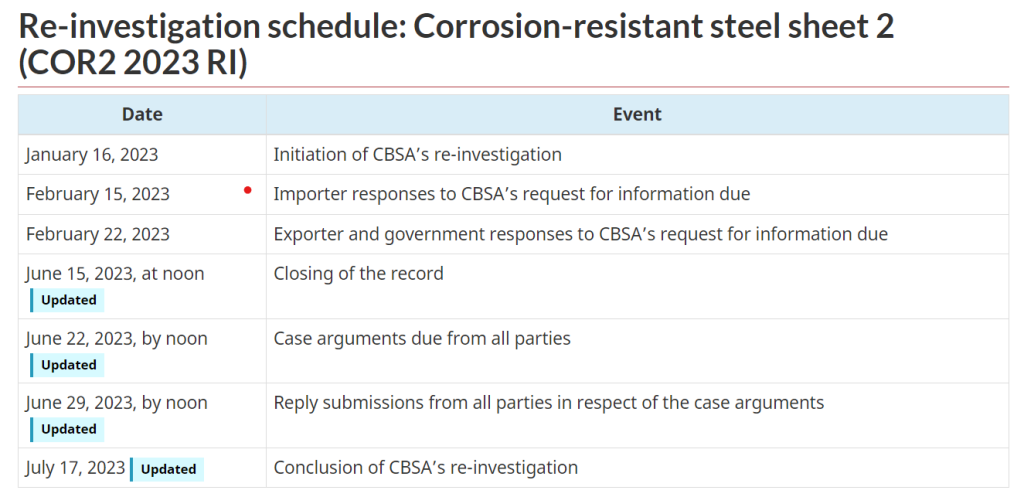

On May 19, 2023, the Canadian Border Services Agency (CBSA) updated a number of important deadlines in the case of administrative review of the order to impose anti-dumping duties applied to certain corrosion-resistant steel sheet originating or imported from Vietnam and Turkey. On November 8, 2019, CBSA initiated an anti-dumping and anti-subsidy investigation on corrosion-resistant…

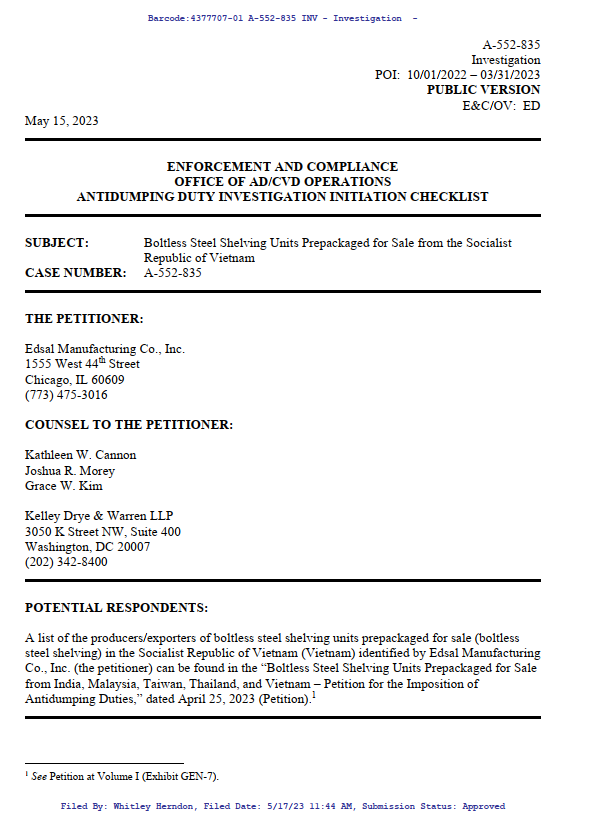

On May 15, 2023, the US Department of Commerce officially issued a notice to initiate an anti-dumping investigation of steel shelving products from Vietnam. The product under investigation is Boltless Steel Shelving Units Prepackaged for Sale with HS code 9403.200075. According to preliminary data from the United States International Trade Commission (USITC), Vietnam exports about…

INTA is a unique event for each individual or organization practicing intellectual property services in the world. Within the framework of the annual conference of the International Trademark Association INTA 2023 in Singapore, ASL LAW has made a deep impression on the company’s activities with representatives of other leading international intellectual property law firms attending…

At the annual INTA (International Trademark Association) Conference in 2023, ASL LAW – representing Vietnam’s leading intellectual property law firms pioneered and actively participated in many activities within the framework of the Annual Conference of INTA 2023 in Singapore. With prestige and experience accumulated over 10 years of operation and development, ASL LAW has affirmed…

On May 16, 2023, US President Joe Biden issued an official statement, vetoing the US Congressional Resolution to abolish the trade remedy duty exemption for imported solar cell products from Vietnam, Thailand, Cambodia, Malaysia. Thereby, enterprises producing and exporting solar battery products from 4 Southeast Asian countries to the US will still keep the status…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語