On May 19, 2023, the Canadian Border Services Agency (CBSA) updated a number of important deadlines in the case of administrative review of the order to impose anti-dumping duties applied to certain corrosion-resistant steel sheet originating or imported from Vietnam and Turkey.

On November 8, 2019, CBSA initiated an anti-dumping and anti-subsidy investigation on corrosion-resistant steel products imported from Turkey, the United Arab Emirates (UAE) and Vietnam.

On October 16, 2020, the Canadian investigative agency issued the following duty order:

• Turkey is subject to anti-dumping duty rates ranging from 0% to 26.1% for 3 specific companies (Duty rate of 26.1% is applied to other subjects of Turkey) and anti-subsidy duty rate range from 0.4% to 3.6%;

• UAE has anti-dumping duty rates ranging from 0% to 41.5% but is not subject to anti-subsidy duty;

• Vietnam has anti-dumping duty rates ranging from 2.3% to 71.1% and is not subject to anti-subsidy duty because the subsidy level is determined from only 0.1% to 0.2% (Below 1% is considered insignificant for a developing country).

This duty rate is applicable for 5 years from November 17, 2020.

However, despite the imposition of duty, the export turnover of dutied products from Vietnam to Canada still increased sharply in 2020 and 2021 with a total turnover of about 4 times higher than 2020 in 2021.

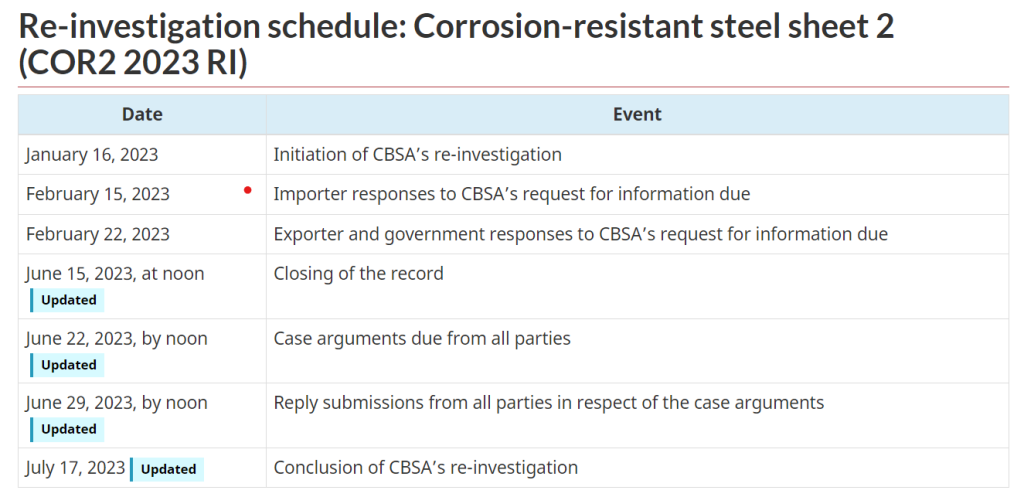

Therefore, CBSA initiated an administrative review to determine a reasonable anti-dumping duty rate on corrosion-resistant steel sheet products on January 16, 2023 to ensure the stability of the market and interests of Canadian domestic producers, avoiding product dumping affecting the national economy.

It is expected that on June 5, 2023, related parties will have to submit all their information and views and arguments related to the case to the Investigation Agency for consideration. On July 10, 2023, the CBSA is expected to issue a conclusion on the administrative review.

However, the above timeframe has changed.

Past timelines:

• January 16, 2023: CBSA begins administrative review

• February 15, 2023: Deadline for importers to respond to CBSA requests for information

• February 22, 2023: Deadline for exporters and governments to respond to CBSA requests for information

Canada updates important deadlines in the case of administrative review of anti-dumping duty orders on anti-corrosion steel of Vietnam

New timelines updated by CBSA include:

1. CBSA ends data collection: June 15, 2023;

2. Deadline for submission of parties’ arguments: June 22, 2023;

3. Deadline for submission of parties’ comments: June 29, 2023;

4. CBSA issues investigation conclusions: July 17, 2023.

In order to receive preferential anti-dumping duty or duty exemption, relevant businesses should contact a reputable anti-dumping and trade remedy law firm early to receive support, consultation in order to respond to CBSA requests in a timely manner.

ASL LAW is the top-tier Vietnam law firm for Anti-dumping & countervailing. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)