On June 4, 2025, the U.S. Department of Commerce (DOC) received a petition requesting the initiation of antidumping (AD) and countervailing duty (CVD) investigations on imports of steel concrete reinforcing bars from four countries, including Vietnam, Algeria, Bulgaria, and Egypt. 1. Case Summary 2. Allegations 2.1. Antidumping Vietnamese exporters are accused of dumping steel concrete…

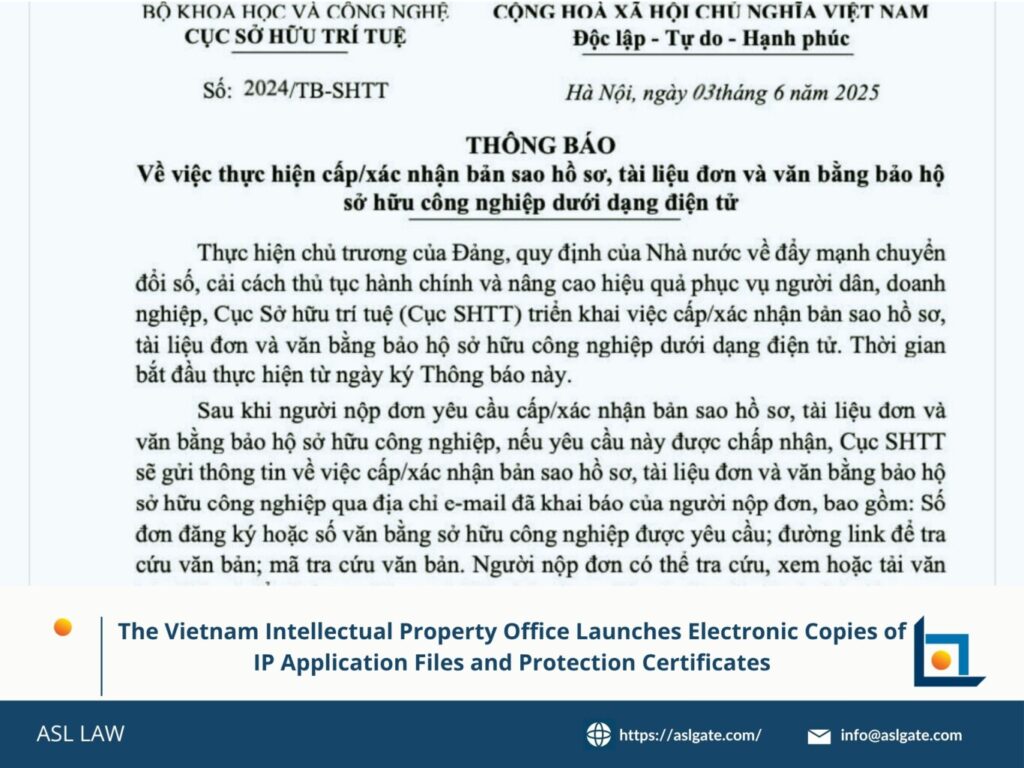

As of June 3, 2025, the Vietnam Intellectual Property Office (IP Vietnam) officially implements the issuance and authentication of electronic copies of industrial property application files, documents, and protection certificates. This marks a significant step forward in the modernization of administrative procedures, helping individuals and businesses save time and effort when conducting intellectual property-related transactions….

On February 21, 2025, the Ministry of Industry and Trade of Vietnam issued Decision No. 460/QD-BCT, imposing temporary anti-dumping duties on certain hot-rolled steel products from India and China. Subsequently, on April 3, 2025, the Vietnam Trade Remedies Authority held a public consultation with relevant parties to assess and determine the product scope in the…

The Trade Remedies Authority of Vietnam has received a request to initiate an anti-dumping investigation against clear float glass products originating from Indonesia and Malaysia. The request was filed by domestic producers representing the Vietnamese manufacturing industry. On June 6, 2025, the investigating authority confirmed that the submitted dossier is complete and legally valid in…

Since March 2018, under President Donald Trump, the United States has imposed additional tariffs of 25% on steel and 10% on aluminum imports pursuant to Section 232 of the Trade Expansion Act of 1962, citing national security concerns. These measures were expanded over multiple phases and continued to be adjusted during Trump’s second term. Notably,…

On May 30, 2025, the International Trade Administration Commission of South Africa (ITAC) – the authority responsible for trade remedy investigations in South Africa – issued its preliminary determination in the anti-circumvention investigation regarding anti-dumping duties imposed on automotive, bus, and truck tyres imported from Vietnam. 1. General Information on the Case 2. ITAC’s Preliminary…

On June 14, 2024, the Vietnam Ministry of Industry and Trade issued Decision No. 1535/QĐ-BCT to initiate an investigation into the application of anti-dumping measures against certain imported coated steel products originating from China and South Korea. The case was initiated based on a petition filed by the domestic industry, aiming to protect the legitimate…

In the context of economic and trade globalization, Vietnamese enterprises are increasingly engaged in cross-border transactions. However, the rapid advancement of digital technology, coupled with the borderless nature of modern commerce, has made international fraud more sophisticated, organized, and difficult to control. As a result, the number of civil lawsuits involving cross-border fraud has been…

Recently, Turkey officially implemented safeguard measures on imports of the chemical product Ethyl Acetate (also known as ethyl acetate) into its market. Notably, Vietnam is not included in the list of exempted countries, meaning Vietnamese exporting enterprises will be subject to safeguard tariffs effective from June 22, 2025. This development will directly impact the competitiveness…

In the context of deepening international economic integration and the rapid development of e-commerce, the trafficking of counterfeit goods and intellectual property (IP)-infringing products in Vietnam has grown increasingly complex. Government authorities are tightening inspections and enforcement efforts to protect the rights of consumers and legitimate businesses, while fostering a healthy business environment. In recent…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語