(Published on Vietnam Law & Legal Forum Magazine)

The negative impacts of the geopolitical tension have indirectly hindered the global economic recovery after the COVID-19 pandemic, preventing the M&A market in 2023 from unfolding as dynamically as anticipated following the less optimistic outcome in 2022.

Nguyen Tien Hoa, Senior Partner & Nguyen Thuy Chung, Senior Partner

The negative impacts of the geopolitical tension have indirectly hindered the global economic recovery after the COVID-19 pandemic, preventing the M&A market in 2023 from unfolding as dynamically as anticipated following the less optimistic outcome in 2022. However, the vibrant developments in international trade cooperation between Vietnam and other countries in the late stages of 2023 are considered a promising bright spot for the revival of the Vietnamese M&A market in 2024.

M&A trends in Vietnam in 2023

According to data released by KPMG Vietnam, the number of transactions in the M&A market in Vietnam during the first 10 months of the year recorded 265 deals with a total value of USD 4.4 billion, significantly lower than the record high of USD 10.8 billion in 2021. The decline in both the number of deals and transaction value has posed challenges in achieving a total deal value of USD 6.8 billion, as in 2022.

Table: Overview of the M&A market in Vietnam in the first seven months of 2023

| Segments | Number of deals | Value (million USD) | Average value (million USD) | Growth rate of value of the deal |

| Real estate and construction | 18 | 564 | 13 | -65% |

| Technology, media and telecommunications | 9 | 29 | 3 | -91% |

| Industrial and automobile production | 4 | 18 | 5 | -25% |

| Financial services | 10 | 1806 | 181 | -53% |

| Energy | 5 | 80 | 16 | -62% |

| Consumption | 10 | 152 | 15 | -88% |

| Medical and health | 6 | 468 | 78 | 1460% |

| Other | 8 | 75 | 9 | -93% |

| Total | 94 | 3192 | 33 | -62% |

The M&A market in Vietnam can be broadly categorized into eight main groups: real estate and construction; technology, telecommunications and media; industrial manufacturing and automotive; financial services; energy; consumer goods; healthcare; and others. Accordingly, the real estate and construction sector holds the highest proportion in terms of the number of transactions in the first seven months of the year, according to EY-Parthenon statistics, followed by the financial services and consumer goods sectors.

Real estate and construction

In the first seven months of 2023, the total value of M&A transactions in the real estate and construction sector reached USD 1.4 billion. Among these, industrial real estate emerged as the most sought-after investment segment by foreign investors. In the construction sector, acquisition transactions were primarily aimed at serving industrial zone development projects.

One of the key attractions of the real estate market in Vietnam is the advantage of pricing when (i) real estate prices in Vietnam, in general, remain lower than many other countries in the region and (ii) both land values and rental prices remain stable, creating opportunities for buyers to acquire projects at attractive prices.

Moreover, as Vietnam is considering revisions to policies related to the real estate sector, including the Land Law, Law on Real Estate Trading, and Law on Housing, an improved legal framework for foreign investors engaging in M&A transactions in real estate is anticipated, positive signals in the efforts to enhance the legal framework in these directly-related regulating laws for M&A projects further demonstrate the potential of this industry for investors.

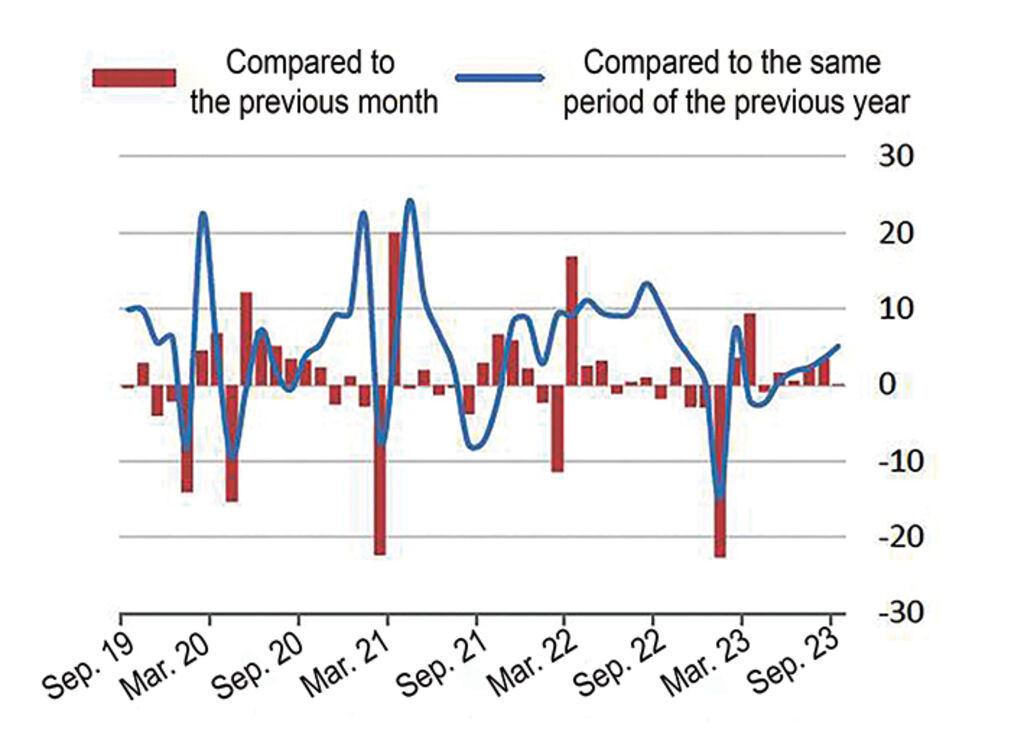

The recovery in industrial production not only reflects continuous improvement in the export of goods but also contributes to the growth of M&A transactions in industrial real estate. According to World Bank data as of September 2023, Vietnam’s economy achieved a growth rate of 5.3 percent (year-on-year) in the third quarter of 2023 compared to 4.1 percent (year-on-year) in the second quarter of 2023. This number is attributed to the gradual recovery of industrial production, evident from the industrial production index’s increase since March 2023. This is also a factor highlighting the attractiveness of industrial real estate in the M&A market.

Industrial production index[1]

Financial and consumer services

The significant potential in Vietnam’s consumer lending market serves as a beacon, attracting foreign investors to participate in financial and consumer-focused transactions. Concurrent with the digital transformation, efforts to build a national data warehouse, and the digitization of citizen data by the Government, financial institutions such as banks are actively promoting digital banking services. According to the State Bank of Vietnam, many fundamental transactions in the banking sector have been completely digitized, with some banks recording over 90 percent of customer transactions conducted through digital channels. Moreover, the high internet usage rate and widespread application of technology in core financial services and banking also provide substantial advantages.

In terms of Financial Technology (fintech) activities, the rapid changes in consumer behavior, coupled with the robust development of e-commerce and the application of blockchain technology, offer immense potential for fintech companies in digital payments, lending, insurance technology (insurtech), and embedded finance. The draft decree on the regulatory sandbox for financial technology activities in the banking sector, submitted by the State Bank of Vietnam to the Government, signals an effort to promote the development of fintech in the country.

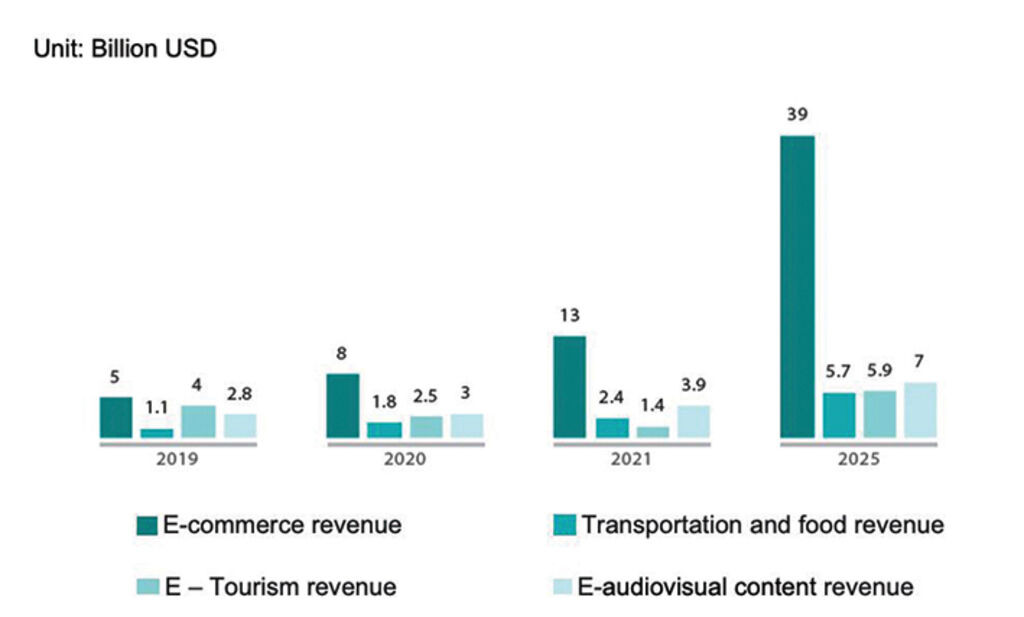

With a flourishing e-commerce market, Vietnam stands as an extremely promising market in the region according to the below visual indicators of the Internet and e-commerce in Vietnam, demonstrating its immense e-commerce potential in the sector, reflecting a highly developed trend in consumer behavior on e-commerce platforms.

Chart: Scale of the Internet economy in Vietnam[2]

Key considerations

Causes leading to the downturn in the M&A market in Vietnam in 2023

From a global perspective, the total transaction value in the M&A market in 2023 has encountered stagnation as investors face worldwide political and macroeconomic uncertainties. The increasing global inflation, along with the rising geopolitical and economic instabilities worldwide, has impacted investor views to some extent, making them more cautious.

According to numerous surveys conducted by reputable organizations worldwide, global M&A activities in 2023 are facing unfavorable conditions, with one of the main reasons being the continuous interest rate hikes by the United States Federal Reserve (Fed). This has led to an increase in financial costs and a decrease in asset prices. Additionally, the tightening of monetary policies in major economies, resulting in higher interest rates, has also impacted emerging markets, making transactions more costly and negatively affecting both the quality and quantity of deals in the market.

Especially, one of the factors contributing to the negative impact on the global political-economic situation in general and the M&A market, in particular, is the disruptions caused by the war between Russia and Ukraine as well as the ongoing conflict between Israel and Hamas. Vietnam, in the process of integration, is inevitably affected by these developments.

Impacts of the Russia-Ukraine war

One of the impacts of the Russia-Ukraine war is the influence on trade and investment activities. A series of sanctions against Russia by Western countries, including the United States, the European Union, the United Kingdom, Australia, and Canada, have been implemented in response to Russia’s attack on Ukraine. These sanctions are having a significant impact on the global economy, and Vietnam is not immune to these effects. Russia being excluded from the SWIFT financial system and the freezing of assets abroad pose challenges to Russia’s trade and investment transactions in Vietnam.

In addition, the Russia-Ukraine conflict disrupts supply chains, impacting Vietnam’s exports and creating challenges for businesses looking to invest in Vietnam. This complication further hinders the due diligence and payment processes in M&A transactions.

Secondly, the war leads to price increases in the market for certain fuel and production-related raw materials, affecting both production and consumer goods. Russia is a leading country in oil extraction and exports, accounting for 12 percent of the global trade volume with about 5 million barrels per day. Restricting transactions with a major supplier like Russia causes oil prices to rise, creating global inflationary pressures and significantly impacting production costs. Due to the impact of sanctions, many shipping companies refuse to transport goods from Vietnam to Russia, leading to increased transportation costs and delays. Air embargo also raises global logistics costs. These delays pose challenges to supply chain management, forcing businesses to change strategies and affecting decisions to expand or engage in M&A. Companies involved in M&A may face delays in project implementation and contract execution, increasing the risk of failure to meet time and cost commitments.

Impacts of the Israel-Hamas conflict

The ongoing conflict in the Middle East region undeniably has adverse impacts such as disruption in trade and investment relations, enhancement of the possibility of occurrence of economic defensive measures; disruptions in the global supply chain and international investment; and currency fluctuation risks, to name just a few.

First of all, the conflict may pose a risk of disrupting trade and investment relations between Vietnam and Israel, creating challenges in negotiations for a free trade agreement and reducing the possibility of investment cooperation.

Secondly, concerns about a reduction in overall consumer demand due to conflicts often lead to an increase in economic defensive measures. This can impact Vietnam’s exports and reduce income from foreign sales.

Thirdly, the conflict can potentially disrupt the supply chain, especially for energy sources such as crude oil. This disruption may pose challenges in the oil supply, negatively affecting M&A projects related to the energy sector. Additionally, political tensions may push investors to shift towards domestic or geographically closer investments. This could create fluctuations in investment flows into Vietnam from other countries, impacting the M&A market.

The global rise in oil prices can pose significant challenges for banks, especially when loose monetary policies are in place. Currency fluctuations may lead to an increased accumulation of assets such as the US dollar and gold, adding further uncertainty to M&A transactions in the field of finance and banking.

Bright spots for the M&A market in Vietnam in 2023

Despite the slowdown in M&A activities in Vietnam throughout most of 2023, several potential factors could drive dealmakers to rise in the coming year. Notably, the elevation of the relationship between Vietnam and the US to a comprehensive strategic partnership, as per the Joint Statement on Economic-Trade-Investment Cooperation between Vietnam and the US is considered a bright spot that is expected to boost transactions and enhance the prospects of the M&A market in Vietnam.

Market opening and policy support

The proposal by Vietnam for the US to consider recognizing its market economy status is a significant development. Such recognition not only provides more favorable conditions for Vietnamese businesses in trade protection cases but also helps strengthen Vietnam’s role, position, and investor confidence in its potential.

Enhancing investment and trade cooperation

The US’s commitment to create favorable conditions for key Vietnamese products, such as textiles, footwear, and agricultural products, will facilitate exports and promote trade cooperation between the two countries. The promotion of the Generalized System of Preferences (GSP) tariff scheme by Vietnam also holds the promise of ensuring that exported goods from Vietnam receive fair treatment, benefiting businesses and stimulating trade between the two nations.

In general, this is expected to enhance the development of M&A transactions, creating greater attraction for investors looking to participate in the import-export market in Vietnam. Additionally, it will increase the investment potential in areas where Vietnam already has a competitive advantage.

Cooperation in priority areas

The two countries are united in enhancing their strategic partnership, focusing on collaboration in areas such as science and technology, innovation, education and training, climate change mitigation, and renewable energy development. This promises to create opportunities for diversification in M&A deals and promote sustainable development.

Specifically, in the fields of digital collaboration, science, and technology, the US and Vietnam are intensifying collaboration in the fields of science, technology, and innovation, particularly in the technology sector. To further enhance the development of the digital economy and attract M&A transactions related to this sector, the US has committed to enhancing support for training and developing a high-tech workforce in Vietnam to achieve these goals.

Regarding the energy sector, Vietnam and the US will collaborate in the energy sector to build a more efficient national energy system, attracting investment and technology to Vietnam. This collaboration opens up opportunities for M&A in renewable energy and green technology.

Vietnam and the US are committed to close cooperation in the energy sector to establish a more efficient national energy system, attracting investment capital and technology to Vietnam. Plans to expand M&A transactions into the renewable energy and green technology sectors are also under consideration by both the US and Vietnam for implementation soon.

About the semiconductor industry, the US is committed to supporting Vietnam in building a semiconductor ecosystem and has outlined plans for workforce development in this field. Both parties are actively committed to supporting and collaborating to enhance Vietnam’s position in the global semiconductor supply chain, providing funding for businesses involved in M&A transactions related to semiconductor manufacturing.

Economic reforms in Vietnam

Vietnam proposes that the US promptly recognize its market economy status to support domestic businesses concurrently with attracting foreign investment into the M&A market. The US expresses appreciation for Vietnam’s efforts in the modernization process and ensuring transparency in monetary policies and exchange rates. The US also commits to supporting Vietnam in this regard, helping create a stable and favorable environment for investors to carry out M&A deals in Vietnam, mitigating risks, and further encouraging proactive cooperation between the two nations.

Collaboration with the World Trade Organization

Both Vietnam and the US are committed to strengthening the multilateral trade system through the World Trade Organization (WTO), aiming to enhance fairness and transparency in the trade environment. Additionally, both parties will commit to rule-based approaches, reducing risks for businesses participating in M&A transactions in Vietnam. Specifically, WTO rules provide a unified legal framework for regulating the negotiation and settlement processes in M&A transactions, helping reduce the complexity of administrative procedures and creating opportunities for collaborative support between the two nations.

Infrastructure development support

The US commits to supporting Vietnam in the production, and development of high-quality physical and digital infrastructure, fair energy transition, and sustainable and smart agriculture, as well as assisting Vietnam in deep and sustainable integration into regional and global supply chains. This helps businesses carry out M&A transactions to expand their scale and business capabilities.

Furthermore, the US International Development Finance Corporation (DFC) will provide financial support for private projects in Vietnam in the areas of infrastructure, climate, health, and small businesses, assisting enterprises in participating in M&A transactions.

Tying it all together, the current market opening, policy support, and commitment to cooperation in strategic areas create a positive environment for the development and expansion of businesses, as exemplified by the collaboration between Vietnam and the US. This not only provides significant opportunities for Vietnamese enterprises but also stimulates cooperation and investment between the two countries, contributing to the growth of the M&A market. This holds the promise of being a bright spot in the M&A investment landscape in 2024. Additionally, political stability, impressive economic growth rates, and a rapidly increasing domestic consumer market with strong FDI inflows provide a solid foundation, indicating favorable conditions for investors eyeing strategic opportunities in Vietnam’s dynamic M&A market in 2024.-

[1] Source: The World Bank, Vietnam macroeconomic update September 2023, page 2

[2] Department of E-commerce and Digital Economy – Ministry of Industry and Trade, 2022. Vietnam E-commerce White Paper 2022. Pg. 32, 37

Read the original article here.

ASL LAW is the top tier Vietnam Real estate law firm and M&A law firm in Vietnam. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)