One of the most significant taxes in any country and a major source of funding for the state budget is the import and export tax. Therefore, businesses must understand what import and export tax is and who is obligated to pay it. The legal system of Vietnam is governed by a number of fundamental legal…

The accountant must determine the taxable income before they may evaluate the payable enterprise income tax. According to Article 2 of Circular No. 96/2015/TT-BTC, revenue from the production, sale, and provision of goods and services, as well as other revenues, is included in taxable income for a tax period. The following formula is used to…

Client’s inquiry: Could you advise us on taxes on cross-border service in Vietnam? Dear Ms. Ji, Regarding your inquiries on tax issues on cross-border services provided by ___ LLC (hereafter refer as Client) to a Vietnamese company, we would like to give you our advice on this issue as follows: The foreign contractor who has…

The personal income tax refund is a problematic issue for most employees that have a high income. Although the amount of money refunded might not be much, it is the right of each employee in Vietnam’s society. So, what are the details of regulations on personal income tax refunds in Vietnam? Personal income tax refund…

On March 17, 2022, the General Department of Taxation has just issued Document No. 769/TCT-TTKT, requesting the Tax Departments of provinces and cities to strengthen measures to prevent loss of revenue, to ensure sufficient collection into the state budget. Document No. 769/TCT-TTKT requires the whole industry to strengthen the inspection of tax law observance at…

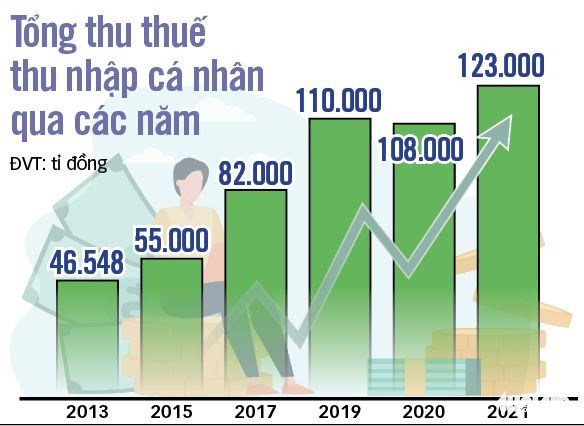

The Ministry of Finance is gathering feedback on proposed changes to the Personal Income Tax Law. Experts have suggested raising the taxable income to VND 15-20 million, lowering the highest tax rate to 25-30 percent, simplifying the tax schedule from 7 to 3 or 4 levels, adjusting the tax rate paid by year, and so…

The Law on Personal Income Tax during the implementation process has revealed many shortcomings, such as the reduction of family circumstances which is too low compared to spending levels, many tax levels and high taxes compared to income. Therefore, experts have made many proposals, including raising the deduction for family circumstances to 20 million dong….

In order to reduce personal income tax (PIT), salaried employees have brought many suggestions to increase the deduction and lower the tax rate this year. Gasoline prices have increased six times during the past two months, pushing up prices of vegetables, eggs, and meat. Moreover, the outbreak of the COVID-19 pandemic made the income and…

The Ministry of Finance’s proposed tax on houses and land has raised many citizens’ concerns. Experts said that it is necessary to avoid affecting the opportunity to access housing for middle- and low-income people in urban areas. If housing taxation is not be calculated conscientiously, many experts believe that this can create opposite effects, causing…

Personal income tax is a very special type of tax in Vietnam. This tax is mostly ignored by the entire population of Vietnam as they are not subject to it. Rather, it is only the rich class in society that has a headache over it. So, what are the notes on personal income tax in…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語