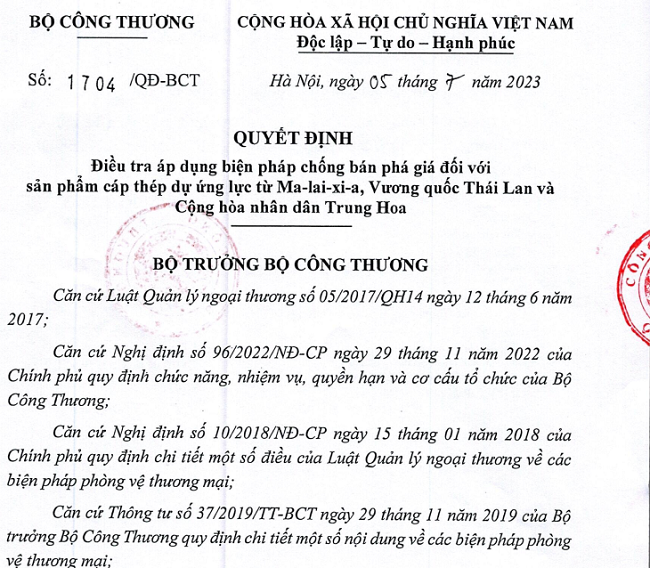

On July 5, 2023, the Ministry of Industry and Trade of Vietnam issued Decision No. 1704/QD-BCT regarding the investigation and application of anti-dumping measures on prestressed steel cable products from Malaysia, Thailand, and China. The investigated products with HS codes 7312.10.91 and 7312.10.99 originated from Malaysia, Thailand, and China, imported into Vietnam. The case number…

Recently, the Ministry of Industry and Trade of Vietnam issued an official announcement regarding the formal acceptance of applications for the end-term review of anti-dumping measures against aluminum products exported from China to Vietnam. On September 28, 2019, the Minister of Industry and Trade issued Decision No. 2942/QD-BCT on the official application of anti-dumping measures…

At Webinar: “Personal Data Protection in Vietnam and Cross-Border Transactions – What’s New?” ASL LAW received very practical questions. In this article, ASL LAW would like to answer those questions. Question 1: How do we exchange information regarding DPO with the local regulator? Is the National Portal on personal data protection launched already? Until now,…

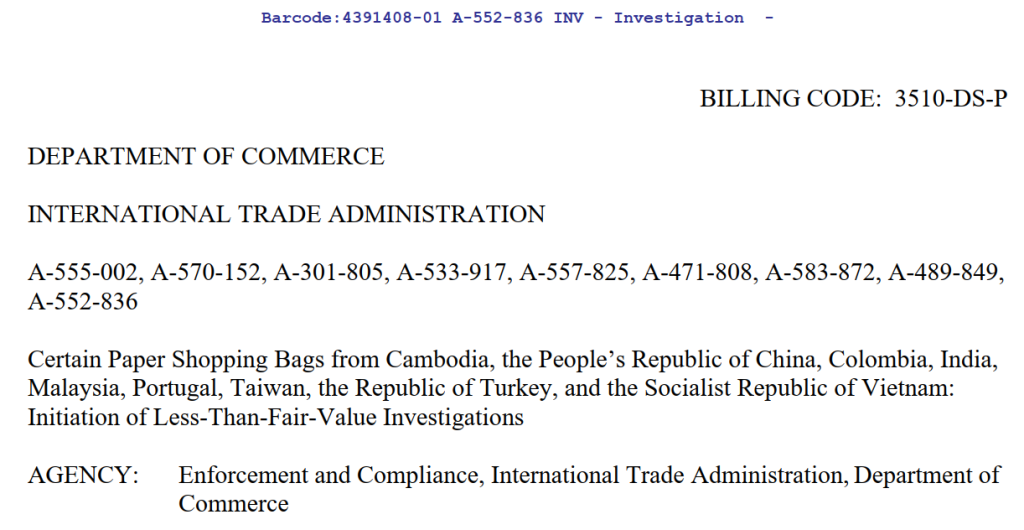

On June 21, 2023, the United States Department of Commerce (DOC) officially initiated an anti-dumping investigation into paper shopping bags imported from Cambodia, China, Colombia, India, Malaysia, Portugal, Taiwan, Turkey, and Vietnam. Based on the petition filed on May 31, 2023, by the domestic manufacturing industry in the United States (Petitioner: Coalition for Fair Trade…

The Ministry of Finance of Vietnam has issued Circular 44/2023/TT-BTC, which stipulates a reduction of 10% to 50% in fees and charges for 36 items, aimed at supporting individuals and businesses in difficult economic conditions, recovering from the pandemic, and international fluctuations. The Ministry of Finance of Vietnam estimates that the reduction of these 36…

According to the current laws of Vietnam, employees have a period of 3 months after resigning from their jobs to submit applications for unemployment benefits. However, due to various reasons, many employees are unable to submit the required documents within this timeframe. Recognizing this drawback, several representative groups of employees have proposed to extend the…

On the morning of June 29, 2023, ASL LAW conducted an online seminar in the form of a webinar with the theme: Personal Data Protection Decree in Vietnam and Cross-Border Transactions. The purpose of this online seminar was to introduce and analyze the legal framework related to personal data protection and the difficulties and considerations…

Vietnam’s social insurance has recently issued Decision 948/QD-BHXH to repeal sections a and b, point 2.6, Article 2 of Decision 595/QD-BHXH to align with Decree 38/2022/ND-CP. Accordingly, the provision that trained employees must have a higher social insurance contribution rate of at least 7% compared to untrained employees in Vietnam has been officially abolished. Article…

Vietnamese regulations on foreign contractor tax are primarily governed by the Tax Law and related implementing guidelines. Here are some important points regarding foreign contractor tax in Vietnam. Foreign contractor tax is imposed on individuals or foreign organizations when they earn income from providing services or supplying goods in Vietnam. Foreign contractors are classified as…

In Vietnam, there are two important concepts related to taxation: “taxable income” and “assessable income.” Here are the basic differences between these two concepts: Taxable income: • This is the amount on which an individual or business is required to pay taxes. It serves as the basis for determining assessable income. • Taxable income includes…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語