In the “Business and Law” program on VTV (Vietnam Television), Lawyer Pham Duy Khuong, the CEO of ASL LAW, presented his in-depth perspective on disputes in investment project transfer contracts in Vietnam.

Dispute Scenario

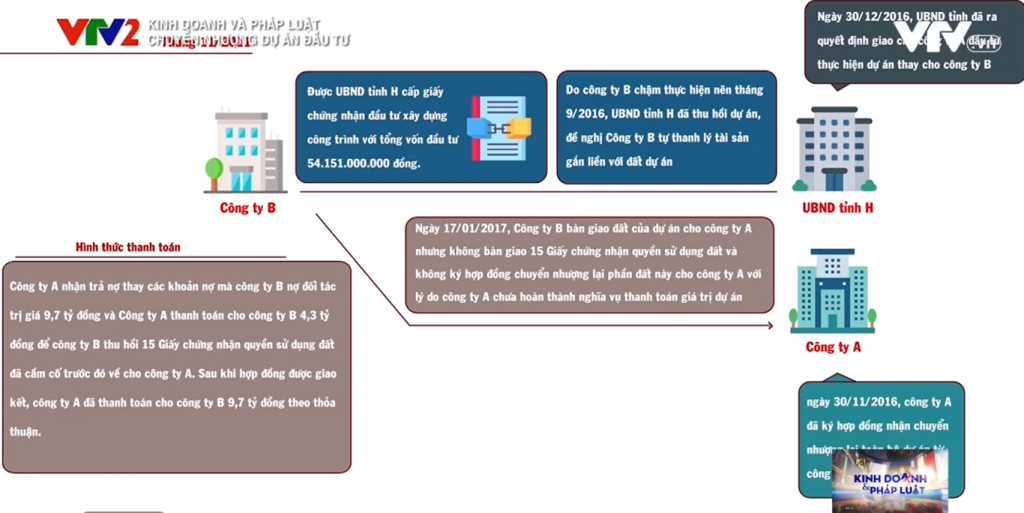

In the program, MC Mai Trang discussed a dispute scenario involving the transfer of an investment project in Vietnam:

In November 2011, Company B received an investment certificate from the provincial People’s Committee (People’s Committee) and was assigned to invest in constructing a project with an area of approximately 34,829m2, with a total investment capital of 54,151,893,009 VND. Due to delays in implementation, in September 2016, the People’s Committee issued a document withdrawing the project and requested Company B to self-settle assets attached to the project’s land.

On December 30, 2016, the People’s Committee of Hau Giang Province issued Document No. 2287, approving Company A to take over and implement the residential-commercial-service project in place of Company B.

However, on November 30, 2016, prior to this approval, Private Enterprise A signed a contract to acquire the entire project from Company B for 14 billion VND. The payment was made through two options:

- Company A paid off debts owed by Company B to third-party creditors, totaling 9.7 billion VND.

- Company A paid Company B an additional amount of 4.3 billion VND for the recovery of 15 land use certificates previously pledged to Company A.

After the contract was concluded, Company A made a payment of 9.7 billion VND, evidenced by the following documents:

- Payment voucher dated December 30, 2016, amounting to 300,000,000 VND.

- Payment voucher dated January 5, 2017, amounting to 325,075,000 VND.

- Receipt dated December 22, 2016, for 20,000,000 VND.

- Money receipt dated January 6, 2017, for 9,090,000,000 VND.

- Direct transfer on January 6, 2017, for 40,000,000 VND, and on January 15, 2017, for 10,000,000 VND without issuing a receipt.

All the above amounts were directly transferred to Ms. P, Mr. D, and TPĐ Company, who were creditors of Company B.

On January 17, 2017, Company B handed over the project’s land to Company A, and Company A hired a unit responsible for landmine clearance and proceeded with the project. However, Company B did not transfer the 15 land use certificates covering an area of 8,232.4m2 within the project’s total area. They also did not sign a transfer contract for this land with the plaintiff, stating that Company A had not fulfilled the obligation to pay the project value to Company B.

On August 15, 2017, Company B proceeded to sign a transfer contract for the 8,232.4m2 (previously transferred to Company A) to DA Company for 3,700,000,000 VND. Simultaneously, they also made a transfer contract for the entire project to DA Company for 15,000,000,000 VND.

Due to the violation of legal rights and interests, Company A filed a lawsuit against Company B in court seeking resolution.

Debating the circumstances in the dispute over the transfer of an investment project contract

MC Mai Trang posed the question: “As outlined in the case details: On December 30, 2016, the People’s Committee of Province H approved the transfer of the investment project to Company A. However, Company A had already signed a transfer contract with Company B on November 30, 2016. Is this one of the fundamental shortcomings of Company A leading to potential risks, in your opinion, Mr. Khuong?”

On this issue, Lawyer Khuong provided several observations:

Upon examining the legal provisions, the Law on Real Estate Business in Article 48, Clause 3, stipulates the principles of transferring the entire or part of a real estate project. It states: “The transfer of the entire or part of a real estate project must be approved in writing by the competent state authority for investment. The investor receiving the transfer is granted a Certificate of Land Use Rights, Ownership of Residential Houses, and other property attached to the land or registered changes in the certificate issued to the transferring investor according to the land laws.”

Additionally, Article 51 of the Law on Real Estate Business outlines the procedures for transferring the entire or part of a real estate project, requiring the investor to submit a transfer proposal to the provincial People’s Committee where the project is located. Within 30 days of receiving a complete and valid dossier, the provincial People’s Committee is responsible for issuing a decision allowing the transfer. If the conditions for transfer are not met, the investor must be informed in writing.

From these provisions, it can be argued that Company B could assert that Company A failed to obtain approval for the transfer of the project from the state authority at the time of contract formation. Hence, Company A may be deemed to have violated the contractual form, lacking legal capacity to proceed with the transfer from Company B.

Moreover, regarding Company A’s acquisition of the investment project from Company B by settling the debts owed to partners on behalf of Company B, Article 370 of the 2015 Civil Code regulates the transfer of obligations as follows: “The obligor may transfer obligations to the successor if agreed upon by the entitled party, except when the obligation is personal or there is a legal prohibition on transferring the obligation.”

Therefore, if Private Enterprise A proceeds to settle debts on behalf of Company B with its partners, there is a risk for Company A that, in the absence of documented agreements transferring obligations between the parties, the partners may assert their right to Company B’s debts and refuse payments from Company A, disregarding the payment transactions.

Consequently, Private Enterprise A will face challenges in proving payment obligations in the project transfer agreement. Despite transferring funds to Company B’s creditors, these transactions may lack legal validity without the consent of the debt partners.

In my opinion, if Private Enterprise A fails to demonstrate the payment of the contract to Company B and lacks approval documents from the state authority, Private Enterprise A puts itself in a precarious situation when entering into the project transfer agreement and executing payment agreements with Company B.

MC Mai Trang continued with another question: “And on August 15, 2017, Company B again signed a contract to transfer the entire project to Company XYZ. How did this action by Company B violate legal provisions, Mr. Khuong?”

Lawyer Khuong explained:

According to the circumstances, on August 15, 2017, Company B continued to sign a contract to transfer the entire project to Company XYZ without officially terminating any transfer contract with Company A.

In this case, two hypothetical scenarios could occur:

- Scenario 1: Company XYZ is aware of the transfer contract between Company A and Company B.

- Scenario 2: Company XYZ is completely unaware of the transfer contract between Company A and Company B.

In both cases, Company B has fundamentally violated legal regulations under the Real Estate Business Law, specifically:

Article 8, Clause 4 of the 2015 Civil Code stipulates “Prohibited acts,” specifically the act of “Deception, fraud in real estate business.”

Furthermore, Article 52 of the Real Estate Business Law details the obligations of the project transferor.

Thus, based on the circumstances, if in Scenario 1, Company XYZ is aware of the transfer contract between Company A and Company B, and there is no official document terminating the transfer contract between Company A and Company B, Company B has violated general contractual provisions in civil law and the obligations of the project transferor in the Real Estate Business Law.

In reality, Company B engaged in fraudulent and deceptive behavior towards Company A. Moreover, Company B failed to fulfill its obligations as the project transferor in the transfer contract with Company A. This action by Company B has caused serious damage, infringing on the rights and interests of Company A.

In Scenario 2, where Company XYZ is completely unaware of the transfer contract between Company A and Company B, Company B not only violated the rights and interests of Company A, as mentioned earlier but also committed another prohibited act specified in Article 8, Clause 3 of the Real Estate Business Law regarding Company XYZ: “Not disclosing or not fully, truthfully disclosing information about real estate.” Additionally, Company B deceived Company XYZ by selling the project, which it had already transferred to Company A.

In conclusion, the act of signing a contract to transfer the project by Company B has seriously violated fundamental legal provisions in real estate business, causing severe damage to the parties involved in the transfer contract. Therefore, according to legal regulations, the transfer contracts between Company B and Company XYZ are null and void.

As the debate session approached its conclusion, MC Mai Trang posed a final question to both guests: “Based on the specific dispute discussed above, may I invite both guests to provide their insights for businesses and investors in the process of both receiving and transferring investment projects?”

Following Mr. Net’s response, Lawyer Pham Duy Khuong shared his opinion:

Firstly, the parties must cross-examine each other’s legal capacities to ensure whether the transferring and receiving parties are eligible to participate in this transaction as per legal regulations.

If either of the parties lacks legal capacity, according to civil law and specialized laws on land, real estate business, the transfer transaction will be null and void. Specifically:

- It must be determined whether the transferring party is the owner of the project. This can be verified through various means, such as requesting the transferring party to provide certificates of land use rights, investment registration certificates, and land allocation decisions from the competent authority. Additionally, it is essential to examine the financial standing of the transferring party, including outstanding debts.

- It must be assessed whether the receiving party has the capacity to accept the transfer. Is the business eligible to operate in real estate? Has approval for project transfer from the competent authority been obtained?

Next, both parties must evaluate the legal status of the project. Is the project being used as collateral for a third party? Is it under seizure or encumbrance? Is there any ongoing dispute? To avoid transactions being declared void due to legal prohibitions, parties need to prevent situations where the project is restricted or prohibited from being transferred.

Finally, regarding the project transfer agreement, to avoid nullification on formal grounds and protect interests during disputes, the agreement must be notarized, documented, and registered with the land registration authority. Particularly noteworthy is the importance of land registration, serving as a basis to confirm the receiving party as the new owner of the project and limiting overlapping transfers.

In terms of content, the agreement must include strict provisions regarding the rights and obligations of all parties, payment timelines, and the project handover process. When drafting the project transfer agreement, seeking advice from real estate experts is advisable. The amount spent on expert assistance, no matter how high, cannot compare to the costs and time involved in dispute resolution.

ASL LAW is the top-tier Vietnam law firm for Investment Services. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語