Vietnam has issued Decision No. 940/QD-BTC related to Investigation and application of anti-dumping measures against some wood fiber products or other wood-based materials originating from Thailand and Malaysia.

-

Basic information

On October 23, 2018, the Department of Trade Protection (PVTM), the Ministry of Industry and Trade received a dossier requesting investigation and application of anti-dumping measures (CBPG) for some wooden fiber board products or by other wood-based materials, whether or not assembled with glue or other organic adhesives, uncoated and unworked with HS code: 4411.12.00, 4411.13.00, 4411.14.00,4411.92.00, 4411.93.00, 4411.94.00 ( goods under investigation ) origin from Thailand and Malaysia. The requester in the case is representative of the domestic manufacturing industry, including 04 companies: (1) VRG Dongwha MDF Wood Joint Stock Company; (2) VRG Kien Giang MDF Joint Stock Company; (3) VRG Quang Tri MDF Joint Stock Company; and (4) Kim Tin MDF Joint Stock Company.

The PVTM Department has issued Official Letter No. 963 / PVTM-P1 dated November 6, 2018 and Official Letter No. 48 / PVTM-P1 dated January 16, 2019, requesting the Party to request additional documents. On January 27, 2019, the requesting Party fully added the required information.

Base on Clause 1, Article 30 of the Government’s Decree No. 10/2018 / NĐ-CP of January 15, 2018, detailing a number of articles of the Foreign Trade Management Law (hereinafter referred to as Decree 10/2018 / NĐ-CP), February 1, 2019, the Investigation Agency with Official Letter No. 105 / PVTM-P1 certifies that the application file is valid and full of the contents specified in Article 28 of Decree 10 / 2018 / NĐ-CP.

Base on the regulations of Clause 5, Article 70 of the Foreign Trade Management Law, February 1, 2019, the investigating agency has sent a letter to the Embassy of Thailand and the Malaysian Embassy in Vietnam notifying the receipt of the document fully and validly.

March 18, 2019, the Ministry of Industry and Trade issued Decision No. 623 / QĐ-BCT on the extension of the decision to issue the case for another 30 days.

As the regulations with Article 79 of the Law on Foreign Trade Management on grounds for conducting investigation and application of anti-dumping measures, the investigating agencies determine that:

– The party requesting the application of anti-dumping measures to meet the requirements of modernity for the domestic manufacturing industry, and

– There is clear evidence that dumping imports cause significant damage to the domestic industry.

The investigating agency took professional opinions of a number of units such as the Ministry of Construction (construction materials, construction materials institute), the Ministry of Agriculture and Rural Development, the Customs Department, the Wood Association and Vietnam forest products, Vietnam Rubber Association on product issues and information on domestic manufacturing industry.

Base on Article 70 of the Foreign Trade Management Law regarding the order and procedures for investigation of trade defense cases and Article 79 of the Foreign Trade Management Law on grounds for conducting investigation and application of anti-dumping measures, as proposed of the director of the Department of Trade Protection (investigating agency), the Minister of Industry and Trade, decided to investigate and conduct the application of anti-dumping measures against investigated goods originating from Thailand and Malaysia (AD06 case code)

2. Contents of the investigation:

The contents of the investigation are carried out in accordance with Article 80 of the Foreign Trade Management Law on the contents of investigation and application of anti-dumping measures and Article 32 of Decree 10/2018 / NĐ – CP on investigation decisions. apply anti-dumping, specifically as follows:

2.1 Goods subject to investigation

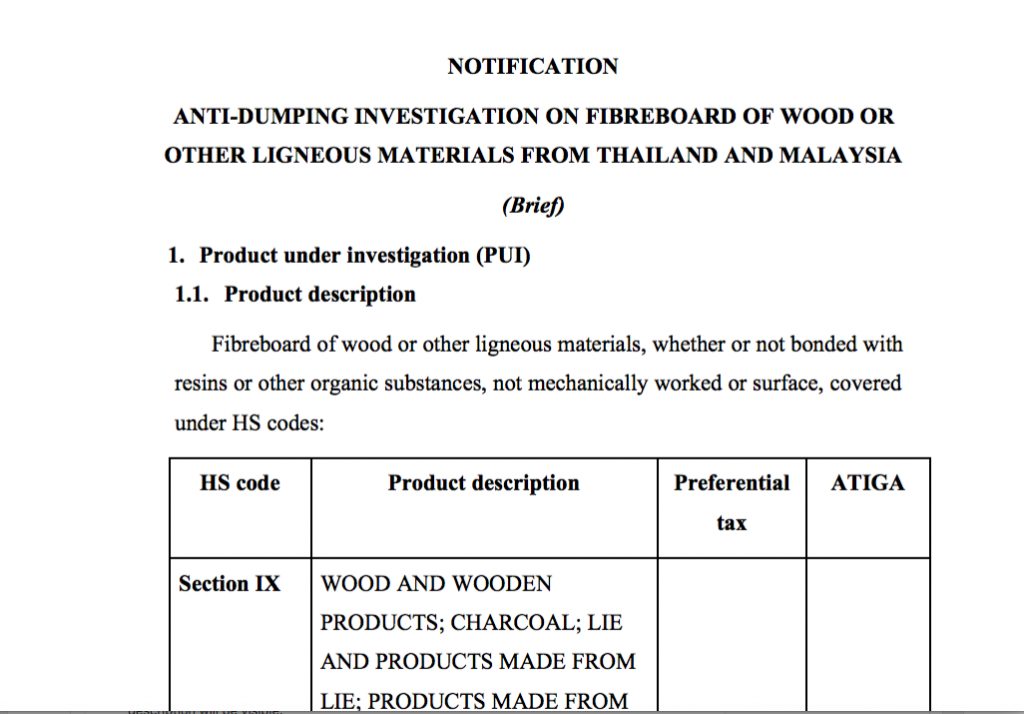

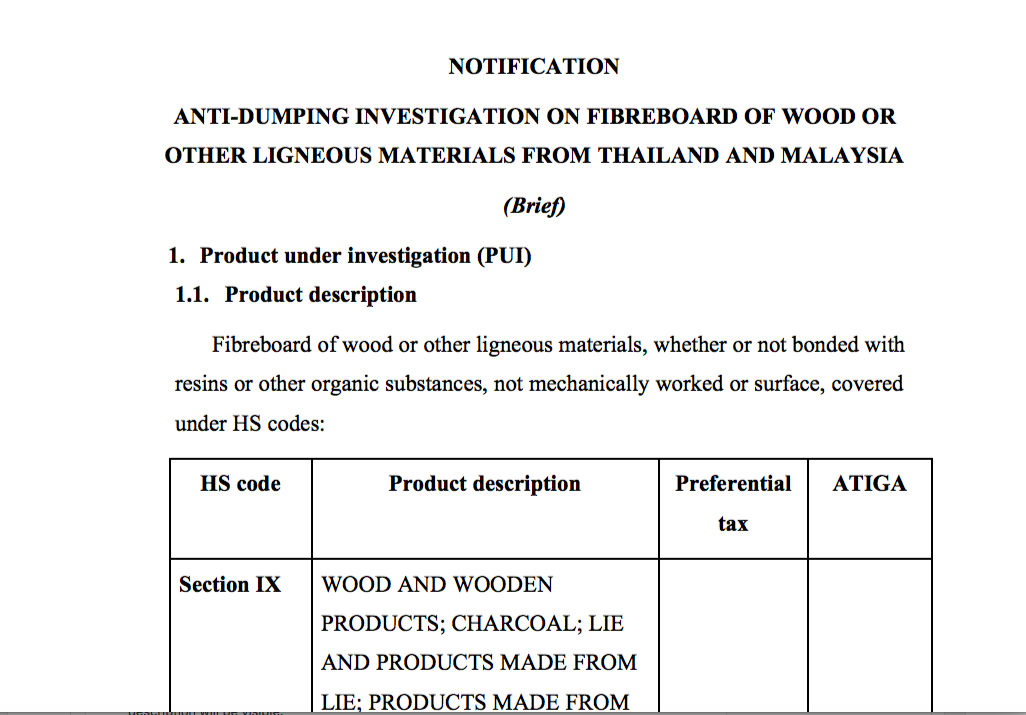

a) Description of goods: Goods subject to investigation are a number of fibreboard items of wood or other ligneous materials, whether or not assembled with adhesive tape or by adhesives. Other muscles not covered with surface and not yet shaped, are classified according to the HS codes as follows:

| HS code | Description of goods | Preferential tax | ATIGA |

| Part IX | WOOD AND WOOD PRODUCTS; LIE AND LIE-MADE PRODUCTS, PRODUCTS FROM STRIP, PAPER OR OTHER MATERIALS AND TEXTILE MATERIALS | ||

| Chapter 44 | wood and wood products; carbon from wood | ||

| 4411 | wood fibers or other ligneous materials, whether or not assembled with glue or other organic binders. | ||

| -Medium density fiberboard (MDF): | |||

| 4411.12.00 | — Of a thickness not exceeding 5 mm | | 8% | 0% |

| 4411.13.00 | — Of a thickness exceeding 5 mm but not exceeding 9 mm | 8% | 0% |

| 4411.14.00 | Of a thickness of over 9 mm | 8% | 0% |

| -Others | |||

| 441192.00 | –Density above 0.8g / cm3 | 8% | 0% |

| 441193.00 | –Density above 0.5g / cm3 but not more than 0.8g / cm3 | 8% | 0% |

| 441194.00 | Density not exceeding 0.5g / cm3 | 8% | 0% |

b/ Origin of the goods under investigation : Thailand and Malaysia

2.2 . Summary of information about dumping behavior and damage

a) Result of appraisal of required documents. Based on the required documents and self-collected information sources, according to Article 79 of the Foreign Trade Management Law, the Investigation Agency considers:

(1) About the filing conditions: The output of the requesting Party and the output of both the requesting party and the supporters in turn accounted for 69, 06% and 84, 42% of the total output of similar goods produced domestically in the country, thus being eligible for phlegm stand. Eligibility is considered to represent the domestic manufacturing industry

(2) Regarding the dumping behavior: The party requires the provision of reasonable bases for calculating the dumping margin of the goods subject to Investigation originating from Thailand and Malaysia.

(3) Regarding damages: The requesting party may provide reasonable information to prove the effect of significant damage to the domestic manufacturing industry, as follows:

– There is a relative increase in the volume of imported goods proposed for investigation from Thailand and Malaysia compared to the total domestic consumption and the trend, the ability to increase products proposed to investigate in the near future.

– to force the price of imported goods to similarly domestically produced goods.

– There are signs of a decline / negative signs in some indices of the domestic manufacturing industry such as sales growth rate; profit ; profit margin ; Salary, actual capacity, inventory.

In addition to the above indicators, a number of threatening factors causing damage to the domestic manufacturing industry have begun to appear such as: some small factories have to narrow production or terminate operation, production capacity redundancy of investigated exporting countries is on the rise.

(4) Regarding causal relationship: The party’s profile requires proved the causal relationship between dumped imports and

significantly damages for the domestic industry.

Therefore, the Investigation Agency determined that the requesting Party’s dossier has met all conditions under the anti-dumping law and proposed that the Minister of Industry and Trade decide to initiate the investigation.

b) Investigation period (POI):

– The period of investigation determines the act of dumping from January 01, 2018 to Dec 31, 2018

– Period of investigation to determine the damage of the domestic industry:

Year 1: From January 1, 2015 to December 31, 2015

Year 2: From January 1, 2016 to August 31, 2016

Year 3: From January 1, 2017 to December 31, 2017

Year 4: From January 1, 2018 to December 31, 2018

c) Proposed Party tax rate proposal:

The requesting party requests the application of anti-dumping duty on goods under investigation at 50,6% for goods exported from Thailand and 18,59% for goods exported from Malaysia.

3. Investigation order and procedures

3.1 Registering related parties

a) Base on Article 5 of Circular No. 06/2016 / TT – BCT of April 20, 2018 of the Minister of Industry and Trade detailing a number of contents on trade defense measures ( Hereinafter referred to as Circular 06/2016 / TT – BCT), organizations and individuals stipulated in Article 74 of the Foreign Trade Management Law can register as related parties in the case with the Investigation Agency to access information Information circulated publicly during the investigation process, sending comments, information and evidence regarding the contents of the investigation referred to in this Notice.

a) Organizations and individuals registering related parties shall follow the form of the related party registration form issued in Appendix I attached to Circular 06/2016 / TT – BCT and send to the Investigation Agency at the address stated at This notice is within thrity (30) days from the date of issuance of the investigation decision by sending an official letter attached to the related party registration application by either of the following methods: (1) post office or (2) email.

c) To ensure their legitimate rights and interests, the Investigation Agency recommends that organizations and individuals producing, importing and using goods subject to investigation register as related parties to exercise the right to continue access to information, information provision and expression of views during the investigation process of the case.

3.2. Investigation questionnaire

Based on Article 35 of Decree 10/ 2018 /NĐ-CP:

Within Fifteen (15) days from the date of the decision to investigate, the agency has sent a question to the investigation for objects as follows :

– The filing party requested to apply the anti-dumping measures

– The other domestic producers

– The party proposed to investigate the application of anti-dumping measures

– Importers of goods are investigated

– The diplomatic mission of the country of origin of the investigated goods

– Other stakeholders that the Investigation Agency deems necessary.

3.3. Select the sample of investigation

In case the foreign manufacturers, exporters, importers and domestic manufacturers are so large or the type of goods is required to apply too large an administrative measure, the Treatment Agency may limit the scope of the investigation. The limitation of the scope of investigation is carried out in accordance with Article 36 of Decree 10/2018 / NĐ- CP.

3.4. Voice and writing

- a) The spoken and written language used in the investigation process is Vietnamese. The related party has the right to use their spoken and the writing. in this case, there must be translation and interpretation.

- b) Information and documents not provided in Vietnamese must be translated into Vietnamese. The related party must ensure the truthfulness and accuracy and be responsible before the law for the translated content.

- 5. Confidentiality of information

The Investigation Agency carries out the confidentiality of information according to the provisions of Clause 2, Article 75 of the Law on Foreign Trade Management and Article 11 of Decree 10/2018 / NĐ- CP.

- 6. Cooperation in the investigation process

Base on Article 10 of Decree 10 2018 / NĐ- CP:

- Any related party who refuses to participate in the case or does not provide necessary evidence or substantially hinders the Upon completion of the investigation, the conclusion of the investigation to the related party will be based on the available information basis.

- Any related party who provides inaccurate or boring evidence will not be considered and concluded that a double investigation with that party will be based on the information available.

- Related parties are Non-cooperative will not be considered for exemption from applying trade remedies under Article 7 of Decree 10 /2018 NĐ – CP.

- The investigating agency recommends that all parties participate in full cooperation in the course of the case to ensure their legitimate rights and interests.

- Temporary measures

4.1. Import management for investigated goods

Since the investigation decision until the end of the investigation process to apply Anti-dumping, the Investigation Agency may implement the regime of requesting import declaration for investigated goods, applying anti-dumping measures to serve the investigation. Import declaration is not limited in quantity, volume or value of imported goods.

Procedures for implementing import management for goods subject to investigation are carried out in accordance with Article 8 of Decree 10/2018 / NĐ – CP and the declaration form in Appendix 2 of Circular 06/2016 / TT – BCT. The Ministry of Industry and Trade will issue a detailed notice in case of applying this measure.

4.2. Applying temporary anti-dumping tax

Based on the preliminary investigation conclusion, the Investigation Agency may propose the Minister of Industry and Trade to decide on the temporary application of anti-dumping tax according to Article 81 of the Law on Foreign Trade and Article Management 37 Decree 10/2018 / NĐ- CP. The temporary anti-dumping tax must not exceed the margin of the value of the preliminary investigation conclusion.

- Consultation

Related parties have the right to request a separate consultation with the Investigation Agency in accordance with Article 13 of Decree 10/2018 / NĐ – CP provided that this consultation does not affect the time limit for investigating the case.

Before the end of the investigation, the Investigation Agency organizes a public consultation session with Related parties. The investigating agency is responsible for notifying the organization of consultations to related parties no later than thirty (30) days prior to the date of consultation. The organization of a public consultation session is carried out according to the procedures prescribed in Article 13 of Decree No. 10/2018 / NĐ – CP.

6. Applying anti-dumping duty effective backwards

a) In case the final conclusion of the Investigation Agency determines that there is a significant loss or threat of causing significant damage to the domestic manufacturing industry, the Minister The Ministry of Industry and Trade may decide to apply anti-dumping duty effective backwards,

b) The applied anti-dumping tax is effective backward for imported goods within ninety (90) days before applying temporary Anti-dumping tax if the imported goods are determined to be dumped, the volume or quantity of dumped goods imported into Vietnam dramatically increases in the period from the time of the investigation to the application. Provisional anti-dumping taxes and potentially irreparable damage to the domestic manufacturing industry

ASL LAW provide anti-dumping service in Vietnam. Contact us for further advice on the case.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)