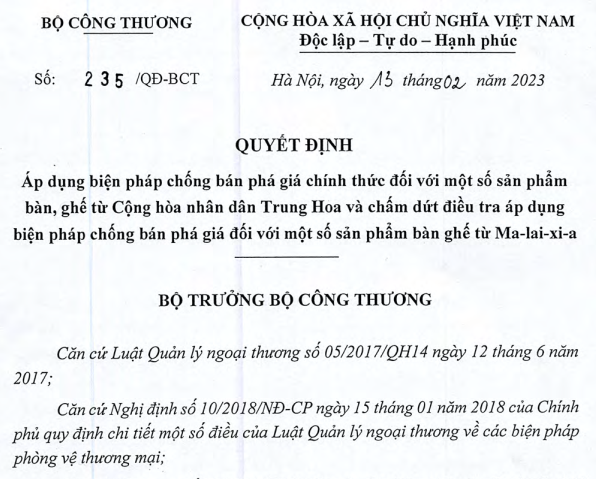

On February 13, 2023, the Ministry of Industry and Trade of Vietnam issued Decision No. 235/QD-BCT on the application of official anti-dumping measures to table and chair products from China and Malaysia.

On September 30, 2022, the Ministry of Industry and Trade of Vietnam issued Decision No. 1991/QD-BCT on the application of temporary anti-dumping measures on table and chair products originating from Malaysia and China.

According to Decision No. 1991/QD-BCT, Vietnam’s temporary anti-dumping duty rate applied to table and chair products originating from China will range from 21.4% to 35.2%. Specifically, the duty rate for chair products will be 21.4% and the duty rate for table products will be 35.2%.

In contrast, on the Malaysian side, based on the investigation results, although dumping behavior exists, because the rate of imported products under investigation from this country is insignificant (less than 3%), therefore, the products under investigation from Malaysia are excluded from the scope of temporary anti-dumping measures.

Official decision for table and chair products from China and Malaysia

According to Decision No. 235/QD-BCT on the application of official anti-dumping measures to table and chair products from China and Malaysia, the official anti-dumping duty rate applied to the products under investigation from China will remain the same under the Decision on temporary imposition of anti-dumping duties issued at the end of September 2022.

Specifically, the anti-dumping duty rate for some table and chair products imported from China into Vietnam will be 21.4% for chair products and 35.2% for table products.

This decision was issued from the conclusion that China’s imports of the products under investigation increased both in absolute and relative to the total domestic consumption and output of similar products of the domestic industry. This is the main cause of significant damage to Vietnam’s domestic manufacturing industry.

On the Malaysian side, although there was dumping behavior, the volume of products imported from Malaysia into Vietnam during the investigation period was insignificant, thereby, the Ministry of Industry and Trade of Vietnam kept the previous decision to not apply anti-dumping measures to some products and chairs from Malaysia.

The official anti-dumping duty against China will be valid for 5 years, applied from the effective date of the Decision on the application of anti-dumping duty, i.e. February 13, 2023, to February 13, 2028. This time limit may be changed according to another Decision of the Ministry of Industry and Trade of Vietnam.

In the near future, the parties concerned can submit the application for exemption from the application of official anti-dumping duty under the provisions of point b, clause 1, Article 16 of Circular 37/TT-BCT dated November 29, 2019 after the official notice on receipt of the dossier was issued by the Trade Remedies Department – Ministry of Industry and Trade of Vietnam.

Decision No. 235/QD-BCT can be downloaded here.

ASL LAW is the top-tier Vietnam law firm for Anti-dumping & countervailing. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語