On April 5, 2022, because no stakeholders requested a periodical review related to anti-dumping measures applied to cold-rolled stainless steel products, the Ministry of Industry and Trade issued Decision No. 625/QD-BCT on upholding the application of anti-dumping measures on some cold-rolled stainless steel products originating from Taiwan (China), the Republic of Indonesia, Malaysia and the People’s Republic of China.

Thereby, within 60 days before the end of 01 year from the date of issuance of the Decision, the stakeholders as prescribed in Article 59 of Decree No. 10/2018/ND-CP dated January 15, 2018, of the Government detailing several articles of the Law on Foreign Trade Management on trade remedies may submit applications requesting a review.

On October 21, 2019, the Ministry of Industry and Trade issued Decision No. 3162/QD-BCT on the results of the end-of-term review of the application of anti-dumping measures to a number of cold-rolled stainless steel products originating from China, Indonesia, Malaysia, and the territory of Taiwan (China).

The case has been reviewed by the Ministry of Industry and Trade since October 2018 in accordance with the Law on Foreign Trade Management and the application file for review by the representative of the domestic manufacturing industry. The investigation is carried out in accordance with the provisions of the World Trade Organization, the Law on Foreign Trade Management, and related regulations.

The investigation results show that after 5 years of applying anti-dumping measures from October 2014 to now, the domestic manufacturing industry has gradually overcome the previous significant damage, but the growth rate is unstable and has a flat trend or a slight decline.

Specifically, with the anti-dumping margin applied, the investigation results show that there is still dumping behavior of enterprises in the market.

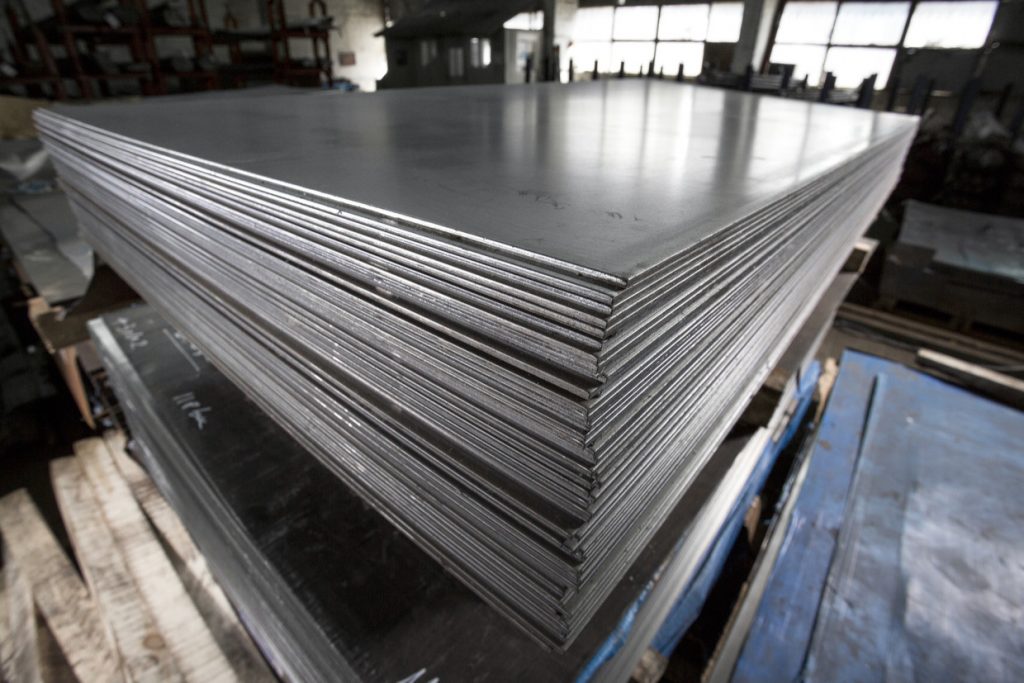

Maintain the application of anti-dumping measures for some cold-rolled stainless steel products

The anti-dumping measure will take effect for 5 years from October 26, 2019. Every year, stakeholders can submit a dossier requesting the Ministry of Industry and Trade to conduct an investigation and review of the infringement products, the anti-dumping duty rate applicable to the new exporter, or the existing tax rate applicable to foreign exporters/producers.

Decision No. 625/QD-BCT takes effect from the date of signing (April 5, 2022).

The Chief of the Office of the Ministry, the Director of the Trade Remedies Administration, and the heads of the relevant units and parties are responsible for the implementation of this Decision.

If the stakeholders need more information about the case, they can contact the Anti-dumping and Subsidy Investigation Department, Trade Remedies Department – Ministry of Industry and Trade.

Details of the Decision can be downloaded here.

ASL LAW is the top-tier Vietnam law firm for Anti-dumping & countervailing. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語