On July 25, 2023, the Vietnam Trade Remedies Administration officially issued a notice of accepting applications for the final review of the case involving the imposition of anti-dumping measures on flat-rolled, painted alloy, or non-alloy steel products from China and South Korea. On October 24, 2019, the Ministry of Industry and Trade of Vietnam issued…

According to information from the Vietnam Timber and Forest Product Association (Viforest), the U.S. Department of Commerce (DOC) will issue its final determination on the anti-circumvention inquiry of anti-dumping and countervailing duties on hardwood plywood imports from Vietnam, following a prolonged delay. Under this final determination, up to 37 Vietnamese companies could be subject to…

With the announcement by UK Prime Minister Rishi Sunak about the completion of negotiations to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and thus formally becoming a member of the CPTPP in the near future, the UK will officially recognize Vietnam, a full-fledged member of the CPTPP, as a market economy in…

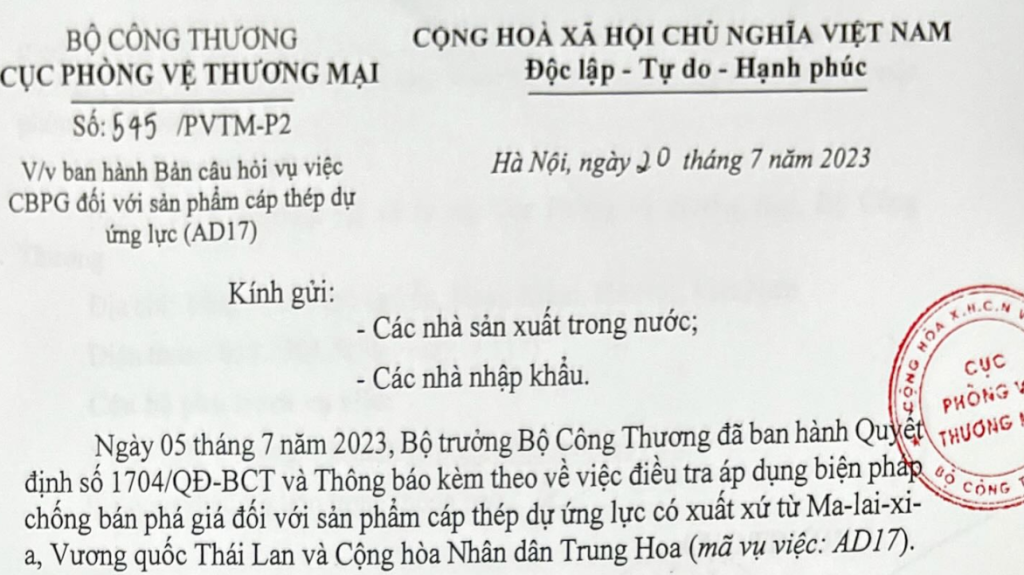

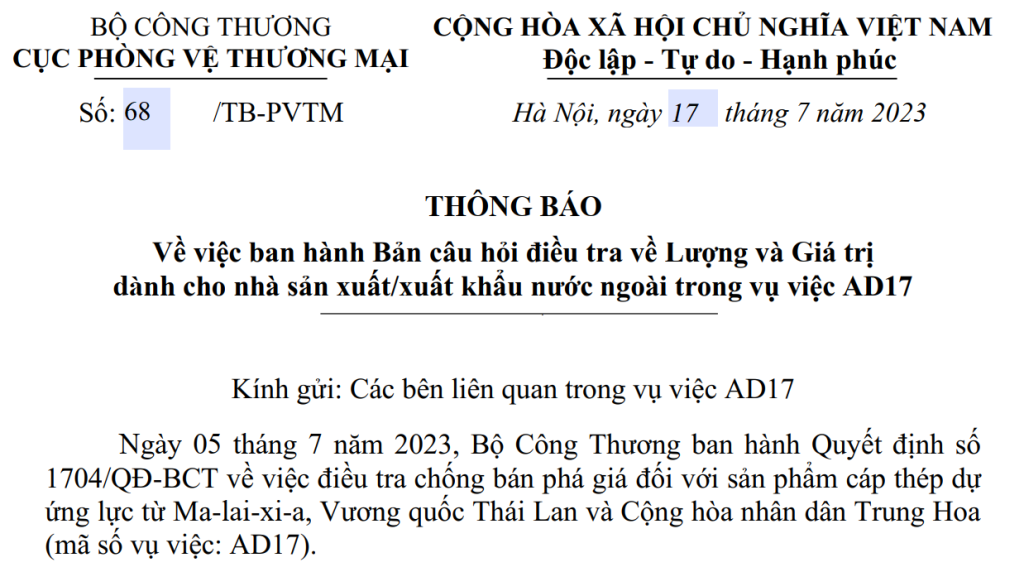

In order to gather more information on the anti-dumping investigation against the imported prestressed steel cable products from Malaysia, Thailand, and China to Vietnam, the Ministry of Industry and Trade of Vietnam has issued Questionnaire No. 545/PVTM-P2 regarding the anti-dumping investigation for prestressed steel cable products (case code: AD17). On July 5, 2023, the Ministry…

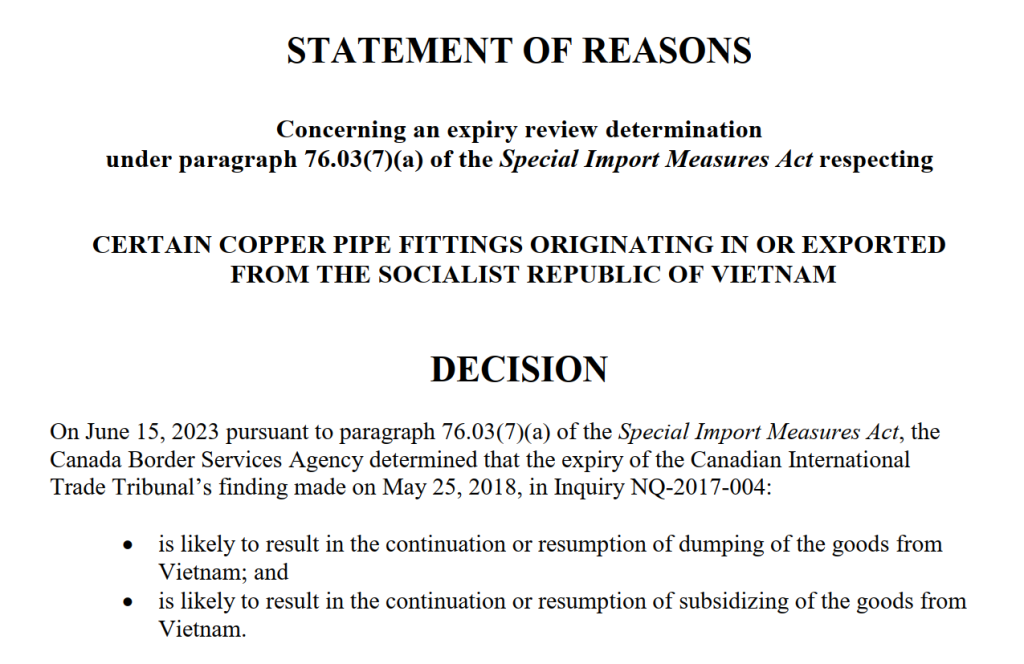

In the end-of-term determination of the anti-dumping and countervailing duty review concerning Vietnamese copper pipe fitting, the Canada Border Services Agency (CBSA) has issued the Final Determination on the situation of dumping and subsidizing of Vietnamese copper pipe fitting. According to the findings, Canada has determined that imported Vietnamese copper pipe fitting from Vietnam are…

On July 17, 2023, the Trade Remedies Administration of Vietnam’s Ministry of Industry and Trade issued Notice No. 68/TB-PVTM regarding the issuance of the Questionnaire on quantity and value for foreign manufacturers/exporters in the AD17 case – the anti-dumping investigation of prestressed steel strand from Malaysia, Thailand, and China. On July 5, 2023, Vietnam issued…

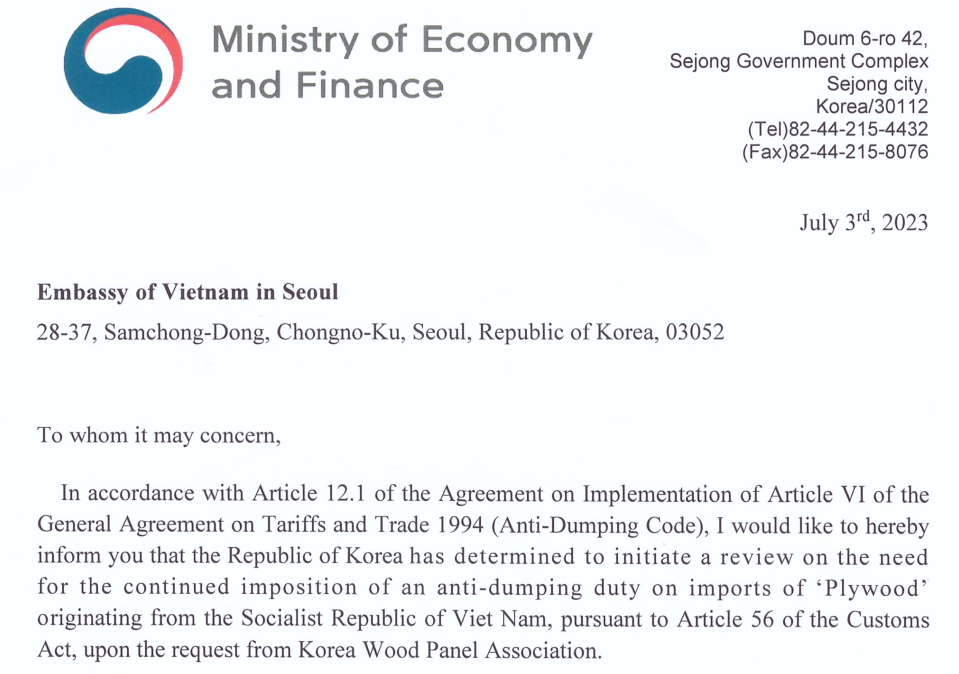

On July 3, 2023, the Ministry of Economy and Finance of South Korea sent a letter to the Vietnamese Ambassador in South Korea regarding South Korea’s initiation of an end-of-term review of anti-dumping duties on plywood from Vietnam. In accordance with Article 12.1 of the Agreement Implementing Article 6 of the General Agreement on Tariffs…

According to the second sunset review decision on the countervailing duty investigation on imported steel coat hangers issued on July 3, 2023, the U.S. Department of Commerce (DOC) announced that it would continue to apply countervailing duties on steel coat hangers imported from Vietnam at a rate of 31.58%. Based on the conclusion of the…

Recently, the U.S. Department of Commerce (DOC) issued a decision to partially revoke the anti-dumping and countervailing duty orders on imported solar energy panels from China related to the solar panel anti-dumping duty order in effect since 2012. According to the DOC’s decision (resulting from a review of changed circumstances initiated by solar energy panel…

During an interview, Trinh Anh Tuan, the Director General of the Administration of Trade Remedies of Vietnam’s Ministry of Industry and Trade, shared some statistics on Vietnam’s trade remedy situation in the first half of 2023 and issued warnings to industry sectors at risk of trade remedy investigations by the end of 2023. By the…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語