(Vietnam) In the Vietnamese version, Circular 16/2021/TT-NHNN requiring the purchase of corporate bonds is likened to a “red line,” acting as a valve to prevent credit money from flowing into hot areas, generating macro instability.

The State Bank of Vietnam has released Circular 16 (November 2021), which regulates the purchase and selling of corporate bonds by credit institutions and foreign bank branches. As a result, the Circular states that credit institutions will be prohibited from purchasing corporate bonds in the following circumstances:

- Corporate bonds are issued with the purpose to restructure the debt of the issuing enterprise.

- Corporate bonds are issued to contribute capital or buy shares in other enterprises.

- Corporate bonds are issued with the purpose to increase the size of working capital.

This Circular will take effect from January 15, 2022.

“Red line” Vietnamese version

Circular 16 would have a specific influence on real estate enterprises, according to Mr. Phan Le Thanh Long, a financial specialist. Financial expert Phan Le Thanh Long assessed that there are some key points as follows:

To begin with, buying issued bonds to pay off old debts is prohibited. Many corporations issue 5- to 10-year bonds, but bondholders have the option to sell them back to the issuer after one year. As a result, a significant portion of new bond issuance is used to buy back (return) old bonds.

Second, do not purchase bonds issued for the aim of investing to acquire other firms. Evergrande, a Chinese real estate developer, has made extensive use of this business to acquire the property through the acquisition of the project’s owner. As a result, similar trades in Vietnam are prohibited by this rule.

Third, newly sold bonds cannot be repurchased; instead, they can only be redeemed after 12 months, preventing the bond “repo” operation and improving the numbers.

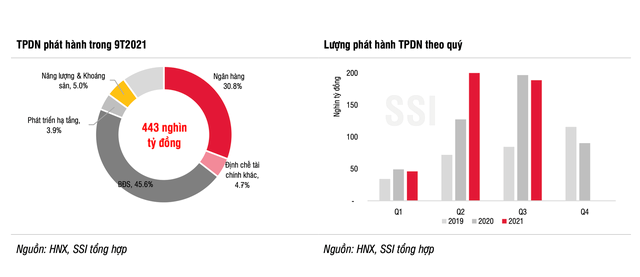

In the first nine months of the year, real estate enterprises accounted for roughly 46% of the entire amount of bonds issued, amounting to VND 201,900 billion. According to a report on the corporate bond market by SSI Securities Joint Stock Firm, collateral for corporate bonds is mostly investment projects, assets that will be produced in the future, or shares of the issuing company itself.

This sum rises to more than 140,000 billion VND if we add real estate bonds that are partially backed by equities (accounting for 67 percent of the total amount of real estate bonds issued in the first 9 months of the year). While corporate real estate bonds have the highest commitment to repurchase, the real estate industry has the highest borrowing to acquire. The slight “red line” in the Vietnamese version appears to be acting as a valve, preventing credit from flowing into hot sectors and perhaps triggering macro instability.

Unsecured issuers account for 15.8% of the overall issuance, which is a significantly high amount. Because a substantial proportion of businesses aren’t listed, their access to financial information is limited. This will be a significant risk for investors if the cash flow of real estate enterprises is not assured due to difficulties in production and commercial activities, and they are unable to pay original debt and interest on the bonds to investor.

SSI further pointed out that securing the duty to pay the bond principal with shares does not make sense since if the organization becomes bankrupt as a result of the breach, the value of the shares used as security (which are normally of the issuer or associated to the issuer) will plummet.

(As cited in cafef.vn)

ASL LAW is the top-tier Vietnam law firm for banking & financial services. If you need any advice, please contact us for further information or collaboration.

|

***Other service of ASL LAW – full service Vietnam law firm *** |

||

|

|

||

|

Oversea investment consultancy for Vietnamese enterprises |

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)