The M&A activities in 2023 are still not as exciting and dynamic as expected. However, with encouraging signals in M&A deals, particularly in the real estate and technology sectors in the latter half of 2023, along with policy changes aimed at attracting foreign investment, the Vietnamese M&A market is expected to recover and thrive in 2024.

M&A trends in 2023

Preliminary statistics on the M&A situation in 2023

According to statistics up to now, it has even been recorded that the volume of M&A transactions in 2023 will decrease even lower than in 2022.

Global M&A deal volume in the first half of 2023 – including various types of deals, such as minority equity deals and venture capital funding rounds – continued to decline compared to last year following record-breaking transaction activity in 2021. As of the first half of 2023, the total value of M&A transactions only reached 1.3 trillion USD, the lowest second level in the past 10 years. The first two quarters of this year had the lowest second and third-quarter deal volumes since 2017.[1]

These figures still do not have a positive trend after the global M&A activities announced in the third quarter. Specifically, the total value of M&A transactions in the third quarter of 2023 only reached 641 billion USD, this is the lowest third-quarter volume since 2013. In addition, the total global M&A transaction volume in 2023 as of the third quarter (1.95 trillion USD) was nearly 1 trillion USD lower than the same period in 2022 (2.91 trillion USD) and is the lowest three-quarter total since 2013 (1.77 trillion USD).[2]

The total number of transactions recorded in each region has shown a decrease in M&A transaction volumes, a common trend globally, specifically in some major markets as follows:

Japanese market[3]

Among major economies in the Asia-Pacific region, only Japan will have an increase in the number and value of M&A deals in the first half of 2023. Accordingly, Japan’s deal value in the first half of 2023 increased by about 50% compared to the first half of 2022, with a strong focus on the technology and healthcare sectors driving the Japanese M&A market. Transactions related to technology dominated in the first half of 2023, accounting for about 40% of total transaction value. In the largest privatization deal, Japan Industrial Partners announced plans to acquire struggling technology giant Toshiba for 15 billion USD. Regarding the healthcare sector, despite the devaluation of the yen, Japanese strategic customers are still interested in acquiring international healthcare companies, to exploit new revenue sources.

North America market[4]

M&A activity in North America mirrors global patterns. After reaching a record high in 2021 and maintaining growth momentum in the first half of 2022, trading activity began to decelerate in the second half of 2022 and into the first half of 2023. From the first half of 2022 to the first half of 2023, North American deal values fell 37%, compared with a 45% decline globally. Despite headwinds, the healthcare, energy, and materials sectors in North America remained relatively positive in 2023.

Europe market[5]

Recent M&A activity in Europe has mirrored global trends. Activity surged to record levels in 2021 and maintained momentum in the first half of 2022, then slowed in the second half of 2022 and the decline persisted into early 2023. S From the first half of 2022 to the first half of 2023, deal values in North America decreased by 37%, while the global decline was 45%. Despite signs of decline, Europe still has bright spots in the areas of green technology, materials and software that have been relatively vibrant in 2023.

Southeast Asia market[6]

M&A activity in Southeast Asia (SEA) has declined since peaking in 2021. After reaching a record high in 2021, SEA deal value cooled in 2022, down 40% compared to the previous year. This decline reflects a lack of large-scale technology deals.

Global economic challenges such as high-interest rates, inflation, supply chain disruptions, geopolitics, and regulatory changes continue to impact trading activity in the first half of 2023. Although value SEA transactions are down 15% compared to the first half of 2022, that is still better than the global decline of 45% year-on-year. This decline occurred primarily due to a decrease in the number of large transactions, which were significantly below both pandemic levels and the regional average of previous years.

However, the automotive, food, and beverage sectors in Southeast Asia remained active in 2023. Specifically, the Automotive sector accounted for about 60% of SEA’s transaction value in the first half of 2023. Projected Reports of strong growth in electric vehicle adoption have helped spur public listings through SPAC mergers. For example, VinFast Auto headquartered in Vietnam merged with Black Spade Acquisition for 23 billion US, and Chinese automaker Lotus Tech merged with L Catterton Asia headquartered in Singapore for $5.5 billion.

Meanwhile, as borders reopened and tourism and leisure activities resumed, SEA’s food and beverage sector saw a sharp increase in trade. Coca-Cola Europacific Partners announced the acquisition of Coca-Cola’s operations in the Philippines for 1.8 billion USD, aiming to become the world’s largest bottler of this iconic beverage.

Due to its geographical proximity to China and more limited acquisition opportunities for Chinese companies in European and American markets, Southeast Asia could become a preferred destination for China’s overseas investments if it accepts it. Furthermore, Japanese acquirers may pursue M&A deals in Southeast Asia to offset slowing domestic growth opportunities in Japan.

In Southeast Asia, Singapore can account for a large share of transactions because its investment environment and financial sector are stronger than those of other countries in the region. Conversely, trading activity in Indonesia could be quieter as investors remain cautious ahead of the country’s general election in February 2024.

Overall, as interest rates continue to stabilize and the macroeconomic picture becomes clearer, valuations will become more certain and transaction activity will increase in the Southeast Asia region.

M&A trends 2023

In general, the M&A market is mainly divided into 8 main groups: Real estate & construction; Technology, communication & telecommunications; industrial and automobile production; Financial services; Energy; Consumption; Health and Wellness; and others. Whereas, according to statistics by EY-Parthenon, among the total number of transactions in the first 7 months of the year, the highest proportion is Real estate & construction, the second is Financial and consumer services and the notable point is the volume of Real Estate & Construction deals is almost double that of the second group.

Table: Overview of the Business Mergers and Acquisitions market in Vietnam in the first 7 months of 2023[7]

| Segments | Number of deals | Value (million USD) | Average value (million USD) | Growth rate of value of the deal |

| Real estate and construction | 18 | 564 | 13 | -65% |

| Technology, media and telecommunications | 9 | 29 | 3 | -91% |

| Industrial and automobile production | 4 | 18 | 5 | -25% |

| Financial services | 10 | 1806 | 181 | -53% |

| Energy | 5 | 80 | 16 | -62% |

| Consumption | 10 | 152 | 15 | -88% |

| Medical & Health | 6 | 468 | 78 | 1460% |

| Other | 8 | 75 | 9 | -93% |

| Total | 94 | 3192 | 33 | -62% |

Real estate and construction

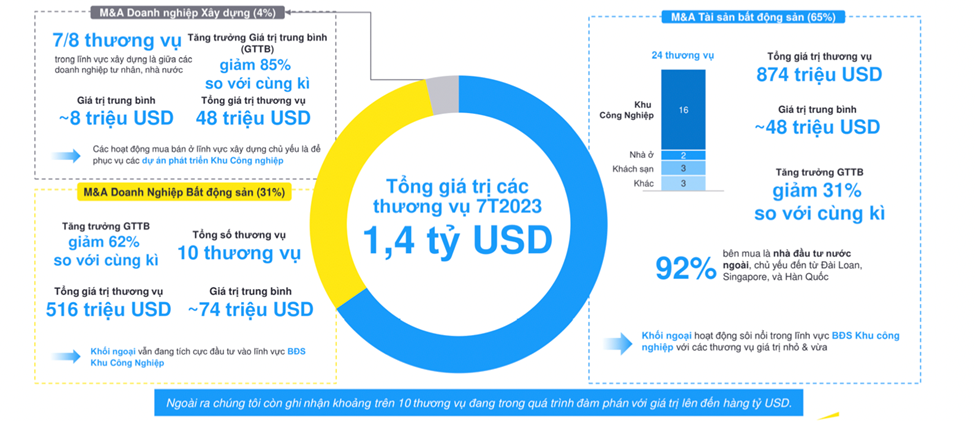

Chart: Overview of the Businesses and Asset M&A market in the Real Estate and Construction sector in Vietnam in the first 7 months of 2023[8]

(Source: MergerMarket, Research and analysis by EY-Parthenon, page 4)

With the total value of deals in the first 7 months of 2023 reaching 1.4 billion USD, the industrial park real estate receives the most attention from foreign investors, the activities of acquisition in the construction sector are mainly to serve the development of industrial park projects.

After the pandemic, Vietnam’s real estate market gradually changed, the leading group showed investors’ confidence in the market’s recovery, as well as showing signs of recovery of the real estate market. With the advantage of price when (i) real estate prices in Vietnam are generally lower than in other countries in the region; (ii) land value and rental prices remain stable which creates opportunities for buyers to acquire projects at attractive prices.

In terms of policy, in the context that Vietnam is in the process of amending the Land Law, Real Estate Business Law, and Housing Law, the legal framework for foreign investors when carrying out M&A transactions in the real estate sector is worth expected, positive signals in efforts to improve the legal framework directly regulating M&A projects show the potential of this sector for investors.

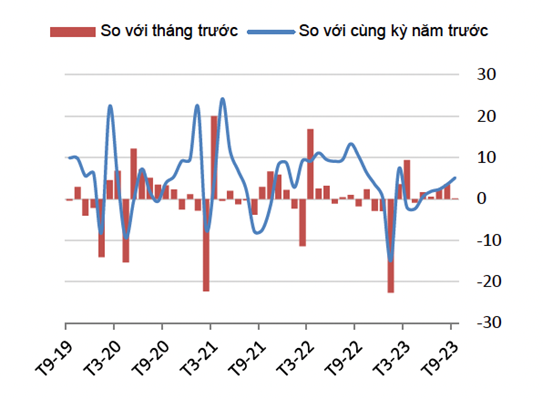

The recovery in industrial production not only reflects the continuous improvement in goods exports but is also one of the causes of the growth in M&A transactions for industrial park real estate. According to the data of the World Bank as of September 2023, Vietnam’s economy reached a growth rate of 5.3% (over the same period) in the third quarter of 2023 compared to 4.1% (over the same period) in the third quarter of 2023, due to industrial production gradually recovering, clearly shown by the increase in industrial production index since March 2023, this is also the reason showing the attractiveness of industrial park real estate in the M&A market.

Chart: Industrial production index in Vietnam[9]

(Source: The World Bank, Vietnam macroeconomic update September 2023, page 2)

Financial and consumer services

An overview of deals in financial and consumer services shows that foreign companies see huge potential for consumer lending in Vietnam. Vietnam is in the process of digital transformation, the state is making efforts to build a national data warehouse and digitize population data, and the private sector such as banks is also promoting digital banking services, according to the State Bank of Vietnam, many basic operations of the banking industry have been completely digitized and some banks have recorded a rate of more than 90% of customer transactions conducted via digital channels [10]. In addition, the high rate of Internet usage and the widespread application of technology in core financial and banking services also bring many advantages.

Regarding financial technology (Fintech) activities, the rapid change in consumer behavior along with the strong development of e-commerce and the application of blockchain technology (Blockchain) has brought a lot of potential to Fintech companies[11] in digital payment, lending, insurance technology (Insurtech) and embedded finance activities [12]. The draft Decree on the Controlled Testing Mechanism of Financial Technology Activities in the Banking Sector (sandbox) has been submitted to the Government by the State Bank as a signal of efforts to promote the development of Fintech in Vietnam.

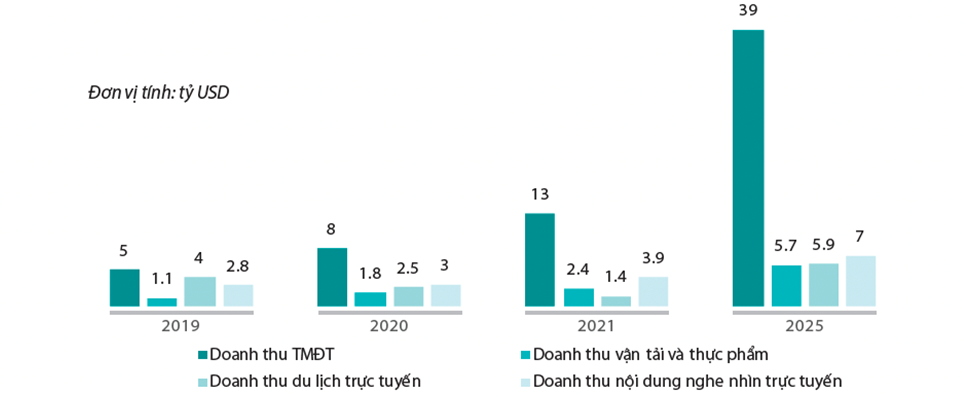

The E-commerce market is developed, Vietnam is an extremely potential market in the region based on the following visual indicators about Vietnam’s internet and e-commerce, showing that Vietnam has commercial potential. E-commerce is very large in the region, and consumer trends in e-commerce are very developed.

The scale of the Internet economy according to the 2022 E-commerce White Paper – Ministry of Industry and Trade

Chart: Scale of the Internet economy in Vietnam[13]

(Source: E-commerce White Paper 2022 – Ministry of Industry and Trade)

Vietnam M&A Prospects in 2024

Sociopolitical situation impacting on M&A

Impact of the Joint Statement between Vietnam and the US on Economic Cooperation

Based on the content of the Joint Statement between Vietnam and the US on Economic – Trade – Investment Cooperation, there are a number of factors that can affect the M&A (Mergers and Acquisitions) situation in businesses as follows:

a, Market Opening and Policy Support

One of the important contents in elevating the comprehensive strategic partnership between Vietnam and the United States is that Vietnam requests the recognition of the United States for market economy status. The United States will urgently consider this request from Vietnam under the provision of laws. Vietnam has strengthened communication on this content right from the preparation stage for official visits and announced the elevation of the relationship to the level of a comprehensive strategic partnership for Peace, Cooperation, and Development. The recognition not only creates more favorable conditions for Vietnamese businesses in trade protection cases but also helps strengthen the role, position, and confidence in Vietnam’s potential in the minds of foreign investors. This is predicted to be one of the factors that strongly impacts the economic market between Vietnam and the US in general and the M&A market in particular, specifically:

- Strengthening trade and investment cooperation:

Opening the market for Vietnam’s key products such as electronics, textiles, footwear, agricultural products, and fresh fruits can create favorable conditions for exports and strengthen two-way trade cooperation between the two countries. In the coming time, the Ministry of Industry and Trade of Vietnam will continue to promote exchanges with the United States to propose the possibility of applying the Generalized System of Preferences (GSP) mechanism for Vietnam. This is an important issue, which will help Vietnam’s export goods be treated more fairly, similar to what US strategic partners currently enjoy, bringing legitimate benefits to the business community of both countries.

In addition, the United States also commits not to use trade defense measures that can help reduce trade tensions, create favorable conditions for businesses, and increase transparency in trade relations between the two countries.

This promises to strongly promote M&A deals, creating greater attraction for investors and investment funds to invest in the import-export market in Vietnam, as well as investment potential in areas such as agriculture, textiles, and garments, which are key industries of Vietnam. At the same time, opening up and raising the level of relations between the two countries also promotes trade between the two countries, encouraging businesses to go to large markets. This will be an opportunity for cooperation and development of SMEs to go international, or attract foreign investment in the above industry groups, contributing to promoting the domestic M&A market.

- Cooperation in priority areas:

Elevating the comprehensive strategic partnership between Vietnam and the United States aims to prioritize cooperation in areas such as technology, innovation, education training, combating climate change, and renewable energy. This can create new opportunities for diversifying M&A transactions while promoting sustainable development.

Digital cooperation, science, technology, and innovation: Accordingly, Vietnam and the United States decided to promote cooperation in science, technology, and innovation in the digital field, considering this a new breakthrough in Comprehensive Strategic Partnership. This is a positive signal for the increase in technology M&A deals (the technology group is currently ranked 3rd among 8 main industry groups in the M&A market in Vietnam in the first 7 months of 2023). At the same time, the United States is committed to increasing support for Vietnam in training and developing a high-tech workforce, which is also an important point in attracting investment in Vietnam with a highly specialized workforce. The two Leaders welcomed the promotion of safe and reliable digital infrastructure in Vietnam, affirming that the above process has the potential to bring new opportunities to enhance the capacity of Vietnam’s innovation community in the digital field, thereby promoting the development of the digital economy and M&A transactions related to this field in Vietnam.

Energy: According to the joint statement, Vietnam and the US will coordinate in the Mekong Delta and Red River Delta regions, in the fields of interdisciplinary adaptation to climate change; pollution reduction, and voluntary technical assistance related to modernizing power transmission infrastructure, integrating renewable energy, developing climate markets, energy storage solutions and improving regulatory frameworks enabling a timely and equitable energy transition. Strengthening cooperation with the United States in the energy sector will contribute to Vietnam building and investing in a more effective national energy system, while also creating opportunities to attract direct investment capital and high technology in this field in Vietnam. Besides, Cooperation in special areas can expand M&A capabilities to new industries, such as renewable energy and green technology.

Semiconductor industry: Both leaders of the two countries support the rapid development of the semiconductor ecosystem in Vietnam and the two sides will actively support and coordinate to enhance Vietnam’s position in the global semiconductor supply chain. formation, Vietnam and the United States announced the launch of human resource development initiatives in the semiconductor field, in which the US Government will provide an initial seeding grant worth 2 million USD, along with other future support from the Government of Vietnam and the private sector. This is an important mark for the development of our country’s semiconductor industry, a positive signal for M&A deals in semiconductor industry production. However, with world experience, developing the semiconductor industry is a long-term path, taking into account decades (for example, it takes up to 60 years in China), so the M&A market in this field is potential but will follow the direction of long-term development instead of short-term profit race.

b, Economic Reform in Vietnam

To effectively implement the framework of the Comprehensive Partnership between Vietnam and the United States, the Prime Minister suggests that the U.S. Department of Commerce promptly recognize Vietnam’s market economy status and continue to focus on promoting bilateral economic and trade relations. Currently, the United States is an important export market for Vietnam, with a total turnover in 2022 reaching nearly USD 109.4 billion (accounting for 29.5% of total exports, according to the General Department of Customs). In anti-dumping investigations, being considered a non-market economy significantly impacts businesses. Furthermore, treating Vietnam as a non-market economy allows the U.S. to apply a nationwide tariff – the tax rate for uncooperative or non-demonstrative businesses, indicating a lack of government control. Therefore, the recognition of Vietnam as a market economy by the United States holds great significance for Vietnam’s manufacturing and export industries and promotes the involvement of other countries in M&A transactions in Vietnam.

In addition, the United States highly appreciates Vietnam’s ongoing efforts in modernization and further enhancing transparency in the framework of monetary policy and exchange rates. This contributes to macroeconomic stability, ensuring the safety and soundness of the banking system. Vietnam’s commitment to modernization and increased transparency in currency and exchange rate management is a crucial step, offering hope for building a favorable business environment for both countries.

Companies engaged in M&A transactions can benefit from an increasingly improved and positive business environment. Support and openness from both sides can create a stable environment based on rules, encouraging investment and sustainable development. Transparency in currency and exchange rate management helps reduce risks for investors. When information about a company’s financial situation, especially concerning currency and exchange rates, is disclosed clearly and promptly, relevant parties can make decisions based on accurate information. Both parties can have a clear view of the true value of the business and the impact of currency factors. International investors often value transparency and truthfulness in financial information, and when they have confidence in the accuracy and transparency of currency information, they may feel more confident in investing and participating in M&A transactions, viewing Vietnam as a stable and transparent destination to ensure the safety of their investments.

c. Collaboration with the World Trade Organization (WTO)

The two leaders advocate for the continued strengthening of a non-discriminatory, open, fair, inclusive, transparent, and rule-based multilateral trading system, with the World Trade Organization (WTO) playing a pivotal role. The WTO holds a crucial position in monitoring and enforcing the fundamental principles of international trade, contributing significantly to building a global trading system that is fair, transparent, and rule-based, ensuring that all members are treated equally without special preferences based on national origin. This enhances predictability and reduces risks for businesses involved in M&A transactions.

WTO rules and commitments can provide a common legal framework for the negotiation and negotiation processes in M&A transactions, helping to reduce complexity and increase proactiveness between parties. In particular, WTO’s development support measures can assist small and medium-sized enterprises in participating in international markets, enhancing competitiveness, and creating favorable conditions for these businesses to engage in M&A transactions.

d. Support for Development and Infrastructure

The United States is committed to enhancing support for Vietnam in manufacturing, developing high-quality physical and digital infrastructure, promoting equitable energy transition, sustainable and smart agriculture, as well as supporting Vietnam’s deep and sustainable integration into regional and global value chains, with a focus on the Mekong Delta region. For this purpose, the United States International Development Finance Corporation (DFC) will continue to provide financing for private sector projects in Vietnam in areas such as infrastructure, climate, efficient energy use, healthcare, and small businesses, including businesses with a focus on climate factors and women-led enterprises. This can support businesses in the process of conducting M&A transactions to expand their scale and business capabilities. The DFC’s emphasis on small businesses with climate factors and women-led businesses can create opportunities for businesses with business models and development goals related to these issues, enhancing the value and attractiveness of businesses in M&A transactions, helping these businesses expand their business scale, and improve competitiveness.

In summary, the positive message that the U.S. will promptly recognize Vietnam’s market economy not only affects trade relations but also has a profound impact on M&A activities, opening up new opportunities and creating favorable conditions for cooperation and investment between Vietnam and the United States. The trade and economic policy support mentioned above can create a positive environment for the development and expansion of businesses, increasing opportunities, and promoting the development of M&A transactions.

Impact of the Russia-Ukraine War

On February 24, 2022, Russian President Vladimir Putin ordered the military to attack Ukraine. Most Western countries, including the United States, the European Union, the United Kingdom, Australia, and Canada, quickly imposed sanctions on Russia in response.

a. Impact on Trade and Investment Activities

Sanctions against Russia will have a significant impact on the global economy, and the Vietnamese economy will not be immune to these effects. Russia has been excluded from the global interbank financial telecommunications network SWIFT, Western countries have frozen $630 billion of Russia’s foreign exchange reserves, and many large banks and financial organizations have frozen Russia’s foreign assets totaling approximately $3 billion. The disconnection of Russia’s financial system from the SWIFT network makes trade cooperation with Russia challenging, affecting Russia’s investment projects in Vietnam, mostly in the fields of electricity, oil, and gas. This also impacts the bilateral trade between Vietnam and Russia in contracts using the Euro. Due to the impact of sanctions, Russian businesses and banks may face difficulties in investing and expanding business operations abroad, including in Vietnam. This could reduce M&A activities that Russia may participate in.

Furthermore, the Russia-Ukraine conflict causing disruptions in the supply chain will affect other interconnected markets, related to payment transactions with businesses. Many of Vietnam’s export enterprises have experienced halted orders, supply chain disruptions, and delays in payment measures. This conflict has also led to sudden and prolonged decreases in the export activities of Ukraine and Russia, continuing to pressure international commodity prices and adversely affecting economically vulnerable countries like Vietnam. For businesses looking to invest or participate in M&A projects in Vietnam, uncertainty in the supply chain and export markets may complicate project assessments and real value estimations. Payment conditions related to M&A transactions may also become more complicated.

b. Rising Prices in the Market for Some Fuel and Production-related Raw Materials and Consumption

Russia is the world’s largest oil producer and exporter, exporting approximately 5 million barrels of crude oil per day, accounting for 12% of the global trade volume with around 2.5 million barrels/day for petroleum products.

The increase in oil prices translates to increased costs for most manufacturing sectors, exerting greater inflationary pressure on the global economy. Many shipping companies have refused to accept orders to transport goods from Vietnam to Russia. The continued increase in transportation costs, coupled with delays in shipping, will seriously impact the trade of goods. Furthermore, the air cargo embargo will lead airlines to choose longer flight routes, increasing costs and putting additional pressure on the global logistics system. It can be said that delays in transportation and logistics pose a challenge in supply chain management. This may require businesses to alter their supply chain management strategies and could impact decisions regarding expansion or mergers and acquisitions (M&A). Additionally, businesses participating in M&A activities may face delays in project implementation and contract execution due to unstable transportation and logistics. This could increase the risk of failure in meeting time and cost commitments.

Impact of the Israel-Palestine War

The ongoing conflict between Israel and Palestine has significant implications for M&A (Mergers and Acquisitions) in Vietnam, particularly amid the escalating tensions between Israel and Hamas. Here is an assessment of the direct impacts on the M&A situation:

Disruption of Trade and Investment Relations: The conflict can disrupt trade and investment relations between Vietnam and Israel. Negotiations for a free trade agreement may be affected, reducing the potential for promoting investment cooperation that Vietnam is anticipating.

Economic Defensive Measures: Political conflicts often lead to increased economic defensiveness due to concerns about a decline in consumer demand. This affects Vietnam’s exports, potentially reducing income from foreign sales.

Supply Chain Disruption and Energy Impact: The conflict can disrupt the supply chain, especially for energy sources like oil. Vietnam, relying on global energy sources, may face challenges in the supply of crude oil.

Shifts in Global Supply Chains and International Investments: Investors may shift their focus to domestic investment or countries closer in proximity during political tensions. This could impact investment flows from European and American countries, posing difficulties in expanding cooperation with Arab nations.

Financial and Banking Effects: Global oil price increases could pose a significant challenge for the State Bank of Vietnam, especially with an already implemented loose monetary policy. Fluctuations in interest rates between the Vietnamese dong and the USD may rise due to a defensive mindset, leading people to hoard valuable assets like USD and gold.

Predictions for M&A Situation in 2024

In 2024, Vietnam is poised to continue attracting Foreign Direct Investment (FDI) due to sustained economic growth, a high-quality workforce, and being a focal point in the transition of investment flows from China, according to Ivan Alver, Co-founder of Global M&A Partners, during a press conference on the sidelines of the GMAP Conference held on November 13, 2023.

Vietnam has become one of the world’s attractive investment destinations with advantages in (i) a young population, (ii) impressive economic growth rates, and (iii) an increasing number of consumers. In recent years, Vietnam has attracted investments from various Asian markets such as Japan, South Korea, Singapore, Thailand, Taiwan, and China, while receiving relatively less investment from Europe and North/South America.

In terms of sectors, attention may be directed towards Real Estate and Construction, Energy, Consumer Goods, and Industrial Manufacturing in the coming year.

Real Estate and Construction are currently leading in the number of M&A transactions in the first seven months of 2023. Policy-wise, modifications to regulations directly governing M&A transactions in this sector, including Land Law, Real Estate Business Law, and Housing Law, are expected by 2024. A clear legal framework is considered crucial, reducing risk appetite and enhancing the attractiveness of M&A deals in this sector. Despite the overall market downturn due to the pandemic’s impact, signs of recovery are emerging, and lower bank interest rates are contributing to a “heating up” of the real estate market. Concurrently, with the development and potential of industrial production, industrial real estate is likely to continue garnering significant attention in investment opportunities.

In the energy sector, renewable energy is a potential market amidst global climate change. In July of the previous year, the Prime Minister issued Decision 843/QD-TTg 2023 on the National Action Program to perfect policies and laws to promote responsible business practices in Vietnam during the 2023-2027 period. One of the tasks set is addressing environmental issues, and improving the legal framework on the environment by 2025. Vietnam is striving to fulfill its Net Zero commitment at COP 26, aiming for net zero emissions by 2050. The Environmental Protection Law 2020 has come into effect with new provisions, such as the introduction of a carbon trading floor to be tested in 2025 and officially implemented in 2028. Over 1900 Vietnamese enterprises are required to undergo greenhouse gas inventory procedures and report annually. These are new regulations, first-time applied, and businesses are currently undergoing training to comply, indicating significant policy-driven potential for market development and investment attraction.

In the consumer goods and industrial manufacturing sector, the vigorous digital transformation of both the public and private sectors in Vietnam, along with the rapid adaptation of the population to these changes, coupled with the high potential for the development of Vietnam’s e-commerce, are highly regarded in the region[14] as factors driving the growth of the consumer industry in the foreseeable future. Industrial manufacturing is expected to benefit from commitments between Vietnam and the United States under the Comprehensive Partnership, commitments related to training support, project funding, as well as Vietnam’s position in the supply chain.

Overall, 2023 witnessed a multitude of challenges for businesses worldwide, specifically in Vietnam, stemming from the prolonged impact of the COVID-19 pandemic, escalating inflation, and global political tensions, notably the conflicts in Russia-Ukraine and Israel-Palestine. Nevertheless, amidst these adversities, the positive indications seen in the M&A market during the third quarter of 2023, driven by shifts in economic, political, and social landscapes, alongside the government’s initiatives to enhance the business environment, prioritize projects related to environmental, social, and governance (ESG) factors, inspire confidence in the robust resurgence and expansion of M&A activities in Vietnam in 2024.

Lawyer Nguyen Thi Thuy Chung, Senior Partner of ASL LAW

[1] Emily Rouleau, 2023. ‘ANALYSIS: H1 2023 M&A Activity Was as Bad as It Seemed’, https://news.bloomberglaw.com/bloomberg-law-analysis/analysis-h1-2023-m-a-activity-was-as-bad-as-it-seemed

[2] Emily Rouleau, 2023. ‘ANALYSIS: Dismal Q3 M&A Deal Volumes Dampen End-of-Year Outlook’, https://news.bloomberglaw.com/bloomberg-law-analysis/analysis-dismal-q3-m-a-deal-volumes-dampen-end-of-year-outlook

[3] Takashi Yokotaki, 2023. ‘The Japanese Perspective’, https://www.bcg.com/publications/2023/regional-perspective-on-m-and-a-market-trends#sea

[4] Lianne Pot, 2023. ‘The North American Perspective’, https://www.bcg.com/publications/2023/regional-perspective-on-m-and-a-market-trends#sea

[5] Jens Kengelbach, 2023. ‘The European Perspective’, https://www.bcg.com/publications/2023/regional-perspective-on-m-and-a-market-trends#sea

[6] [6] Jared Feiger, 2023. ‘The Southeast Asian Perspective’, https://www.bcg.com/publications/2023/regional-perspective-on-m-and-a-market-trends#sea

[7] Vietnam International Arbitration Center, 2023. Workshop documents: M&A in the real estate sector, managing risks and promoting investment potential, Page 7.

[8] Vietnam International Arbitration Center, 2023. Workshop documents: M&A in the real estate sector, managing risks and promoting investment potential, Page 7.

[9] The World Bank, 2023. Vietnam macroeconomic. Vol. September 2023, page 2.

[10] Chi Tin, 2022. There have been basic 100% digital banking operations, Vietnam Financial Times, https://thoibaotaichinhvietnam.vn/da-co-nhung-nghiep-vu-co-ban-ngan-hang-so-hoa -100-113782.html

[11] State Bank of Vietnam, 2023. Current status and solutions for financial technology development in Vietnam.

[12] HyperLead, 2023. Vietnam Fintech Market Report 2022. Ho Chi Minh: HyperLead.

[13] Department of E-commerce and Digital Economy – Ministry of Industry and Trade, 2022. Vietnam E-commerce White Paper 2022. Pg. 32, 37

[14] Indicators shown in the 2022 E-commerce White Paper – Ministry of Industry and Trade.

ASL LAW is the top-tier Vietnam law firm for in-depth legal advice in Vietnam and internationally. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語