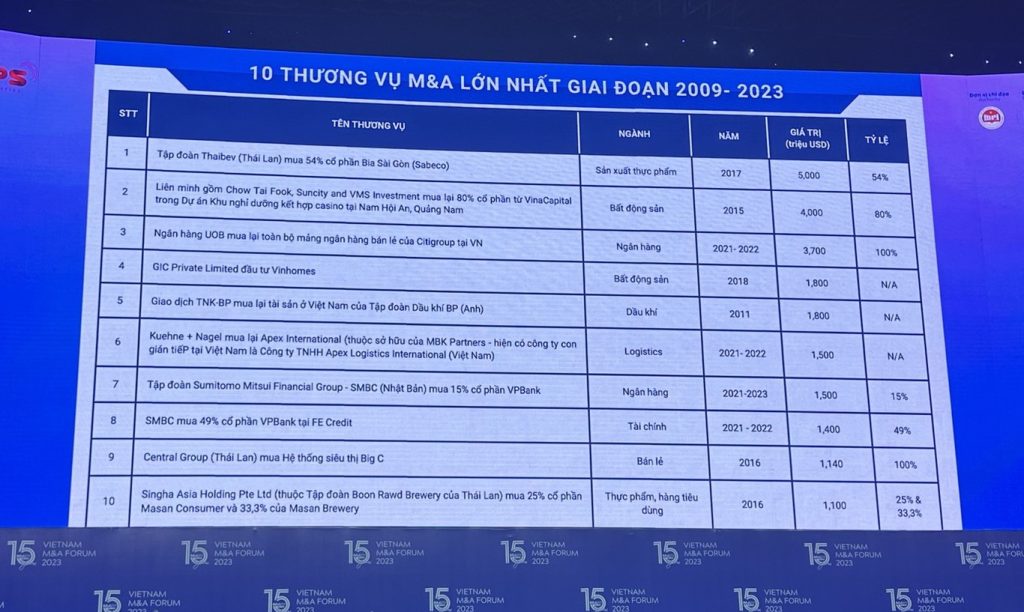

Within the framework of the M&A Vietnam Forum hosted by Investment Newspaper on November 28, the Organizing Committee disclosed the ten most substantial M&A transactions, considering their transaction values from 2009 to 2023.

1. ThaiBev Group (Thailand) acquires 54% of Saigon Beer (Sabeco)

On December 18, 2017, Vietnam Beverage accomplished a successful auction, acquiring more than 343 million Sabeco shares at the rate of VND 320,000 per share, constituting approximately 53.59% of the total shares. The comprehensive transaction amount reached nearly VND 110 trillion, corresponding to USD 5 billion. Notably, this transaction stood as the most substantial M&A deal within the Asian beer industry at that time, taking the forefront in terms of value amidst the trend of foreign enterprises acquiring Vietnamese businesses.

2. Consortium of Chow Tai Fook, Suncity, and VMS Investment acquires 80% of VinaCapital’s stake in the Resort and Casino Project in Nam Hoi An, Quang Nam

In late 2010, the investment license for the Nam Hoi An resort project was issued, with a registered capital of USD 4 billion for the partnership between VinaCapital and Malaysia’s Genting Berhad. However, by 2012, Genting surprisingly pulled out of the project.

In 2015, a coalition comprising Chow Tai Fook, Suncity, and VMS Investment revealed the purchase of an 80% stake from VinaCapital for USD 4 billion in the Nam Hoi An Resort and Casino Project.

3. UOB Bank acquires Citigroup’s entire retail banking segment in Vietnam

At the beginning of 2023, UOB Bank declared the successful finalization of the purchase of the retail banking division, involving the transition of 575 Citigroup employees in Vietnam. This forms a component of the larger agreement with Citigroup, announced in January 2022, to transfer the retail banking segment across four markets—Vietnam, Malaysia, Thailand, and Indonesia—to UOB, with an overall valuation of USD 3.7 billion.

4. GIC Private Limited invests in Vinhomes

In April 2018, Vingroup disclosed a cooperation agreement, effective from April 12, with the Government of Singapore’s GIC Private Limited. Pursuant to this agreement, GIC committed to investing a sum of USD 1.8 billion, through share purchases and providing loans to Vinhomes for the execution of projects.

5. TNK-BP acquires assets in Vietnam from BP (UK)

In 2011, TNK-BP announced the attainment of an investment license in Vietnam, thereby formalizing the purchase of BP’s assets valued at USD 1.8 billion, which encompassed certain assets in Venezuela.

TNK-BP acquired a 35% ownership share in BP’s venture within block 06.1, including the Lan Tay and Lan Do gas fields; a 32.7% stake in BP’s South Con Son Gas Pipeline and associated storage facilities and port; and a 33.3% stake in the Phu My 3 power plant.

6. Kuehne + Nagel acquires Apex International

In 2021, the Swiss-based global logistics group Kuehne + Nagel, which has been active in Vietnam for more than 25 years, entered into a USD 1.5 billion agreement to purchase Apex International Corporation. Apex International is among the top freight forwarding companies in Asia and operates as a subsidiary under MBK Partners, with a related entity conducting operations in Vietnam known as Apex Logistics International.

7. Sumitomo Mitsui Financial Group – SMBC (Japan) acquires 15% stake in VPBank

In October 2023, VPBank announced the successful completion of the private placement, selling 15% of shares to Sumitomo Mitsui Banking Corporation (SMBC), thereby making Japan’s second largest bank a strategic shareholder. .

VPBank completed a private placement agreement with SMBC at the end of March. This bank offered to sell more than 1.19 billion shares to SMBC, a member of Sumitomo Mitsui Financial Group (SMFG), Japan. The total value of the private placement amounted to more than 35.9 trillion VND (equivalent to nearly 1.5 billion USD). All shares issued for the strategic partnership are restricted from transfer for the next 5 years.

8. SMBC acquires 49% stake in VPBank’s FE Credit

In October 2021, VPBank reported the successful conclusion of the divestment of a 49% equity stake, valued at USD 1.4 billion, in Consumer Finance Company Limited (FE Credit) to Sumitomo Mitsui Banking Corporation Consumer Finance, a wholly-owned subsidiary of Japan’s Sumitomo Mitsui Financial Group.

Following this transaction, Consumer Finance Company Limited underwent a name change to VPBank SMBC Consumer Finance Company Limited. VPBank retained a 50% share of the charter capital in FE Credit, while the remaining 1% was acquired by another investor.

9. Central Group (Thailand) acquires Big C supermarket chain

In 2016, the French-based Casino Group, the proprietor of the Big C brand in Vietnam, announced reaching a final agreement to sell Big C Vietnam to Central Group, a conglomerate based in Thailand. Casino disclosed that the enterprise value of Big C Vietnam amounted to one billion euros (equivalent to USD 1.14 billion). Additionally, the group specified that it would receive 920 million euros, approximately USD 1.04 billion (equivalent to around VND 23,300 billion), following the completion of this transaction.

10. Singha Asia Holding Pte Ltd acquires a 25% stake in Masan Consumer and 33.3% of Masan Brewery

In 2016, Masan Group Joint Stock Company entered into a strategic cooperation agreement with Singha Asia Holding Pte Ltd from Thailand in a deal valued at USD 1.1 billion. This agreement involved the infusion of new capital, enabling Singha to acquire a 25% ownership stake in Masan Consumer Holdings and a 33.3% stake in Masan Brewery.

Typically, during the M&A Forum, ASL LAW is awarded one of the Outstanding Vietnam M&A Advisors from 2009-2023.

ASL LAW is the top-tier Vietnam law firm for in-depth legal advice in Vietnam and internationally. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)