Future-formed real estate (FFRE) transactions are increasingly common in the market, especially in major urban areas. However, since the asset does not yet exist at the time of contract signing, investors must carefully assess legal factors to minimize risks. Below are some key legal considerations: Legal Conditions of the Project Before signing a purchase agreement,…

From July 1, 2025, voluntary social insurance (VSI) participants who meet the required age and contribution period can start receiving pensions. Specifically, those who contributed to VSI before January 1, 2021, and have completed 20 years of contributions will be eligible to retire immediately upon reaching 60 years old (for men) and 55 years old…

The USA government has just announced a new tariff policy, applying to over 180 trade partners worldwide. This move is seen as one of the most assertive measures by the USA to adjust the trade balance and protect domestic manufacturing. Countervailing Tariff Rates and Scope of Application According to a statement by USA President Donald…

On April 2, USA President Donald Trump signed an executive order imposing countervailing import tariffs on dozens of economies. Vietnam is among the countries subject to the highest tariff rate, reaching up to 46%, second only to China at 34%. Meanwhile, countries such as the UK, Brazil, and Singapore face a 10% tariff, whereas the…

On April 1, 2025, the Ministry of Industry and Trade issued Decision No. 914/QD-BCT regarding the imposition of temporary anti-dumping duties on certain galvanized steel products originating from China and South Korea. According to this decision, the highest temporary anti-dumping duty applied is 37.13% on goods from China and 15.67% on goods from South Korea….

On March 28, 2025, the Directorate General of Trade Remedies (DGTR) of India officially launched an anti-dumping investigation into Elastomeric Filament Yarn originating from China and Vietnam. The investigated product is Elastomeric Filament Yarn, classified under HS codes 54024400 and 54041100. This type of yarn, commonly known as Spandex or Elastane, is widely used in…

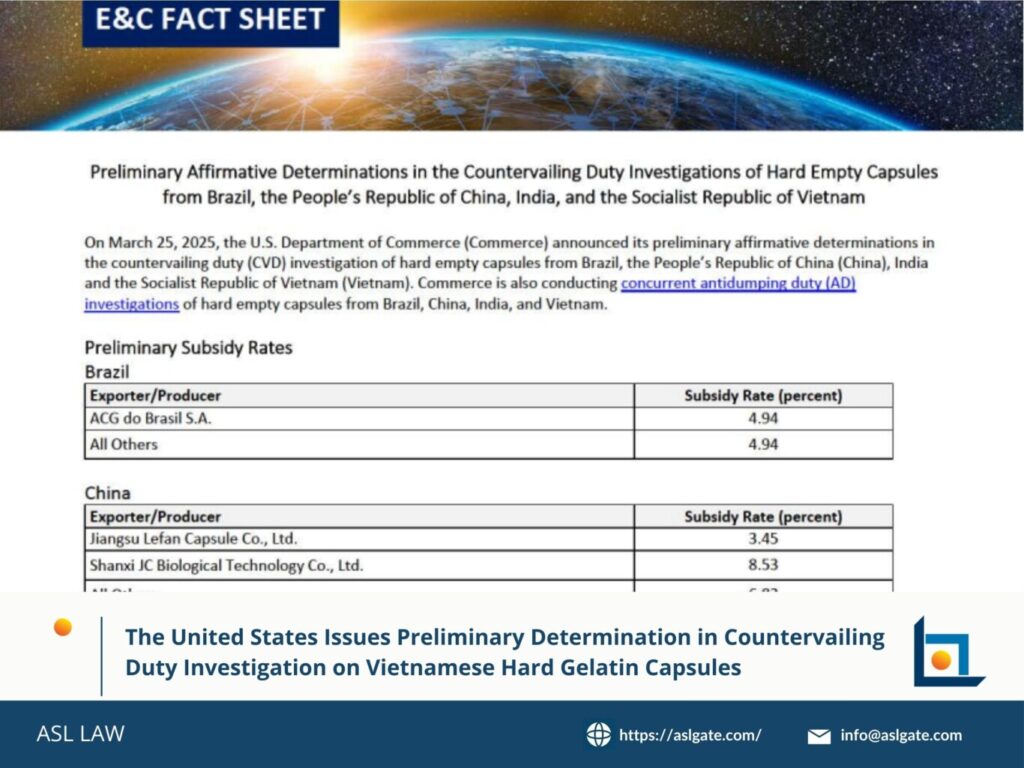

On March 25, 2025, the U.S. Department of Commerce announced its preliminary determination in the countervailing duty investigation concerning imports of hard gelatin capsules (HS codes 9602.00.1040 and 9602.00.5010) from Vietnam. This investigation was initiated by the DOC on November 20, 2024, at the request of U.S. domestic producers. During the investigation, the DOC selected…

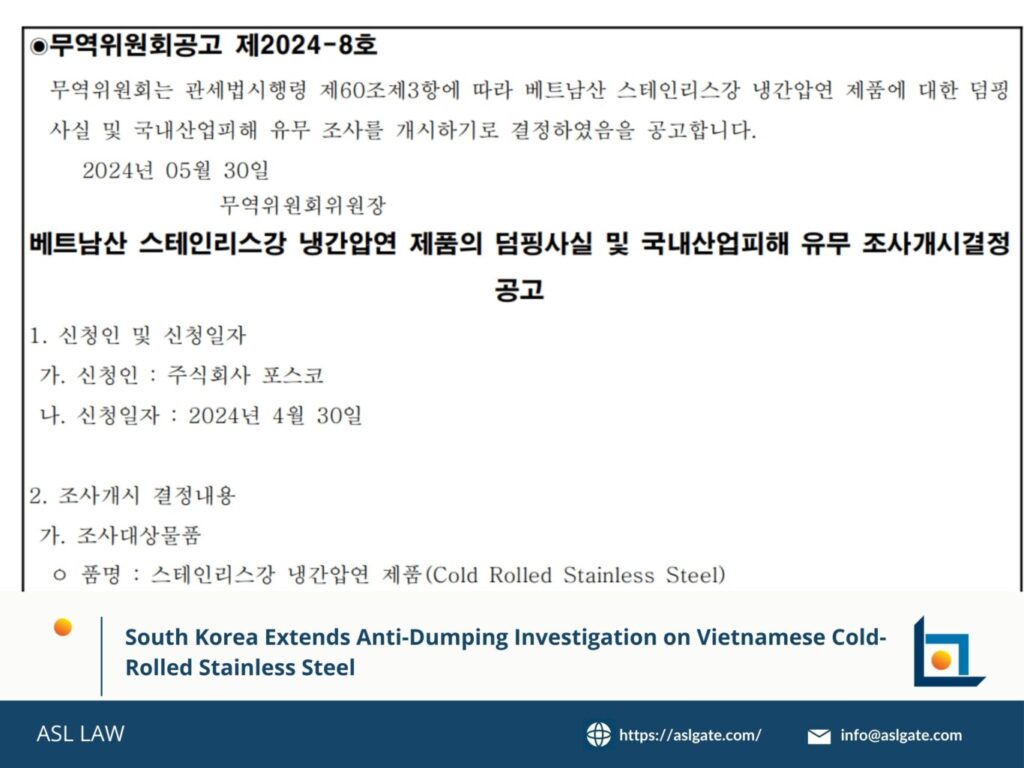

The Korea Trade Commission (KTC) has recently issued a decision to extend the anti-dumping investigation period for Vietnamese cold-rolled stainless steel. The investigation timeline is as follows: The extension was granted due to a shortage of personnel at KTC, as the number of trade remedy cases has been increasing. Previously, on May 30, 2024, KTC…

Throughout thousands of years of human history, women have always been subjected to disadvantages and inequality. In Vietnam, this situation has persisted due to the traditional mindset of ‘male preference,’ passed down from generation to generation, affecting women’s rights in society. In the modern era, although Vietnam’s 2019 Labor Code No. 45/2019/QH14 (“2019 Labor Code“)…

During the resolution of civil and administrative disputes, mediation and dialogue at the Court play an important role in helping the parties find a solution without having to go through a prolonged trial process. This is a dispute resolution method based on agreement, with the support of a mediator or judge, aiming to achieve consensus…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語