During the past time, due to the impact of Covid – 19 epidemic production and business of many enterprises have encountered difficulties. The question is how to pay salary to employees during the Covid 19 (NCOV)? Recently, Ministry Of Labour, War Invalids And Social Affairs has issued guidance on this with the following highlights. Workers have to…

CLIENT’S INQUIRY. Hotel cancelation due to Covid 19 (NCOV): Information about consumer rights and law in Vietnam The reason I searched about consumer’s right is that the hotel in Vietnam I reserved is unlikely to refund the reservation fee although this COVID 19 (NCOV) has spread all over the world. I explained them that the flight has…

CLIENT’S INQUIRY Dear ASL LAW, I have known reputation of your firm in terms of Vietnam Labor Law and I am seeking some legal assistance and advice regarding a labour dispute with my company in Hanoi. I have a full-time definite contract with my company, as well as having a valid work permit. They decided…

(Published on Vietnam Investment Review). After successfully consulting on many anti-dumping lawsuits involving foreign companies, Pham Duy Khuong, managing director of ASL Law, talked with VIR’s Hoang Oanh some important contents related to anti-dumping laws that foreign companies should pay attention to when digging into the Vietnamese market. Anti-dumping regulations are among the important issues…

CLIENT’S INQUIRY: SETTING UP A FITNESS (GYM & YOGA) COMPANY IN VIETNAM Thanks for your email. I am working alongside L and we plan to open a company that will be owned by the 2 of us – a Singaporean national and a British national. The business activities will be fitness activities. The fitness activities is…

After 10 years of implementation of Law on Tax Administration has achieved many positive results. However, in addition to the achieved results, there are still difficulties and challenges in tax administration activities, including tax management for businesses providing cross-border services on Internet (Published on Vietnam law Magazine). On November 29, 2006, the National Assembly for…

Legal advices to dispute abroad, Legal advices to Contract dispute, Legal advices to Employee, Legal advices to Enterprises/Employers, COVID 19 (NCOV) IN VIETNAM, Featured News, Employment & Labor, Investment Law, Business, News

Corona (Covid -19) in Vietnam: Can force majeure events be applied? Legal notes to foreign businesses affected by the epidemic in Vietnam.

Due to Corona (Covid -19) many parties have breached their duties under the signed contract/SPA. Shall Corona (Covid -19) cause legal disputes to foreign businesses and even Vietnamese enterprises in Vietnam. Therefore, the article shall analyze legal disputes in terms of application of majeure conditions. According to Vietnam law, for business contracts affected by the…

Legal advices to dispute abroad, Legal advices to Contract dispute, Legal advices to Employee, Legal advices to Enterprises/Employers, COVID 19 (NCOV) IN VIETNAM, Featured News, Employment & Labor, Investment Law, Business, News

Covid -19 in Vietnam: Can force majeure events be applied? Legal notes to foreign businesses affected by the epidemic in Vietnam.

Due to Corona (Covid -19) many parties have breached their duties under the signed contract/SPA. Shall Corona (Covid -19) cause legal disputes to foreign businesses and even Vietnamese enterprises in Vietnam. Therefore, the article shall analyze legal disputes in terms of application of force majeure conditions. According to Vietnam law, for business contracts affected by…

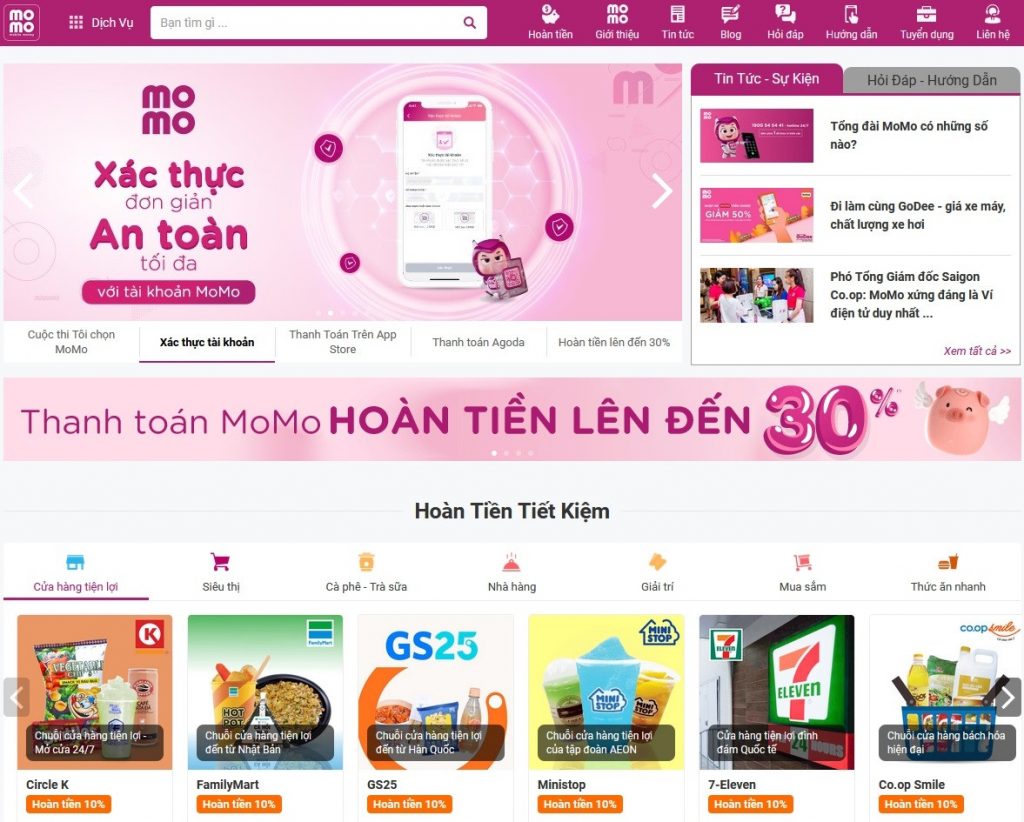

(VIR.COM.VN). A recent draft decree from the State Bank of Vietnam raised eyebrows with its contents on ownership ratios for overseas groups when it comes to payment intermediary services. Lawyer Pham Duy Khuong, managing director of Vietnam Law Firm ASL LAW, writes about whether or not the foreign ownership limit should indeed be restricted for…

(Published on Vietnam Investment Review). Last year was an impressive one for Vietnam’s mergers and acquisitions (M&A) market, and M&A in Vietnam is projected to remain on a steady growth path in the coming years. Pham Duy Khuong, managing director of ASL Law firm, provides notes on Vietnam’s legal framework in this area, making way…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語