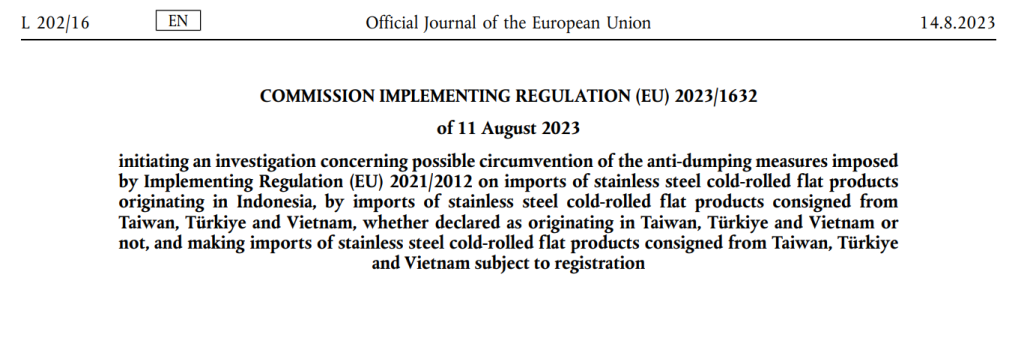

On August 14, 2023, the European Commission (EC) issued a Notice initiating anti-circumvention investigations concerning anti-dumping and anti-subsidy duties on cold-rolled stainless steel products from Vietnam, Taiwan, and Turkey.

The investigated goods consist of flat-rolled stainless steel products that have not undergone excessive cold rolling, originating from Indonesia. The products subject to investigation are classified under HS codes 7219 31 00, 7219 32 10, 7219 32 90, 7219 33 10, 7219 33 90, 7219 34 10, 7219 34 90, 7219 35 10, 7219 35 90, 7219 90 20, 7219 90 80, 7220 20 21, 7220 20 29, 7220 20 41, 7220 20 49, 7220 20 81, 7220 20 89, 7220 90 20, and 7220 90 80.

The complainant in this case is the European Steel Association (EUROFER).

According to the investigation carried out by the European Commission, there has been a shift in trade flow following the application of anti-dumping and anti-subsidy measures on Indonesian goods by the EC. This shift involves the diversion of goods from Indonesia to Vietnam, Taiwan, and Turkey, allegedly aimed at evading the trade remedy measures imposed on goods originating from Indonesia. The products involved in circumvention subsequently continue to be exported to the European Union (EU) market.

During the investigation process, the EC found evidence indicating that activities involving assembly and completion of products from stainless steel billets/sheets, and/or hot-rolled steel, constitute circumvention behavior. These activities became apparent or increased only after the initiation of the anti-dumping and anti-subsidy investigation against Indonesia.

The volume of goods allegedly involved in circumvention has significantly increased in the European market, which could potentially harm domestic production.

EU initiates an anti-circumvention investigation as a trade remedy measure for cold-rolled stainless steel products from Vietnam

According to EU trade remedy law, the investigation is expected to conclude within 9 months from the effective date of the Notice.

In terms of procedural deadlines:

- Relevant parties must present themselves before the investigating authority within 15 days from the effective date of the Notice.

- Relevant parties or legal representatives must submit written responses, opinions, exemption requests, or other necessary information within 37 days from the date of publication in the EU Official Journal.

- Relevant parties can request consultations with the EC within 37 days. For consultation regarding initiation, relevant parties must submit their requests to the EC within 15 days from the effective date of the Notice.

To safeguard their legitimate interests, relevant parties should engage with a reputable legal firm specializing in anti-dumping and trade remedy in Vietnam and internationally to receive timely assistance.

For more details, refer to the announcement here.

ASL LAW is the top-tier Vietnam law firm for Anti-dumping & countervailing. If you need any advice, please contact us for further information or collaboration.

Top of Form

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語