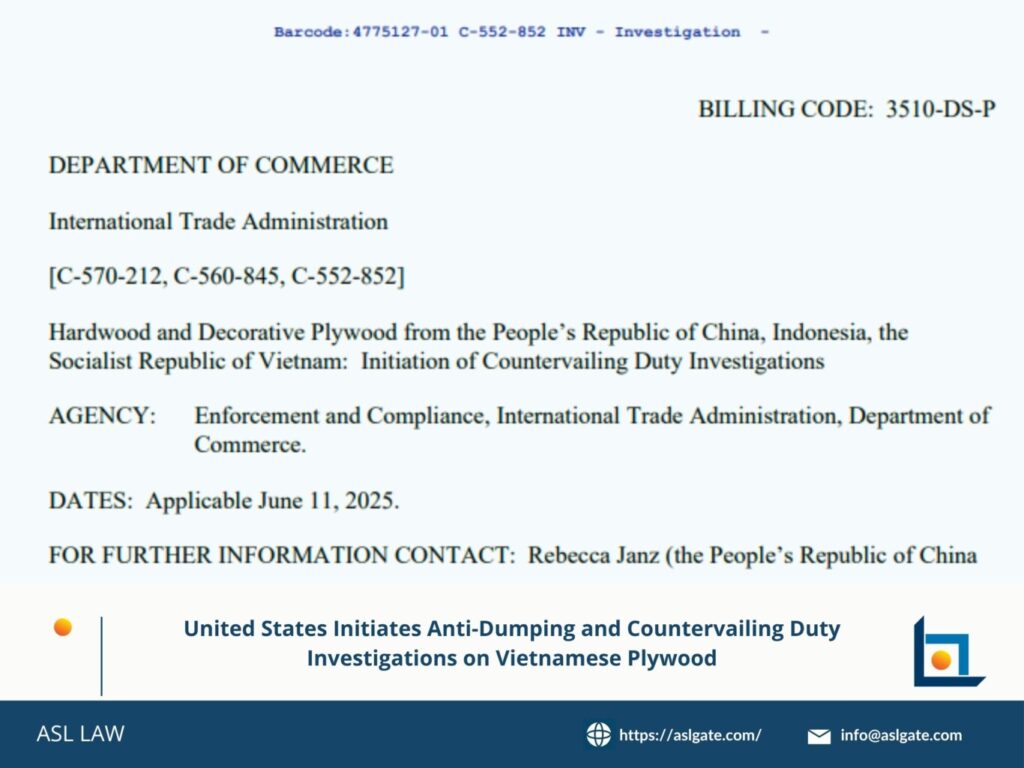

On June 11, 2024, the U.S. Department of Commerce (DOC) officially initiated anti-dumping (AD) and countervailing duty (CVD) investigations on imports of decorative and hardwood plywood from Vietnam.

1. General Information

- Case numbers: A-552-851 (AD) and C-552-852 (CVD)

- Petitioner: Coalition for Fair Trade in Hardwood Plywood (U.S.)

- Petition filed on: May 22, 2025

- Investigated product: Decorative and hardwood plywood (main HS codes: 4412 and 9403)

- Countries investigated: China, Indonesia, Vietnam (all subject to both AD and CVD investigations)

- Vietnam’s export data (source: ITC):

- 2022: approx. USD 401 million

- 2023: approx. USD 186 million

- 2024: approx. USD 244 million

- Vietnam ranks second in export volume among the investigated countries.

- Number of Vietnamese companies implicated: Nearly 100

2. Scope of Investigation

2.1. Anti-Dumping Investigation

- Period of Investigation (POI): October 1, 2024 – March 31, 2025

- Period of Injury Investigation: 2022–2024

- Alleged dumping margins: 138.04% – 152.41%

- Calculation method:

- Export price: Average price during the POI

- Normal value: Based on surrogate country data, as Vietnam is treated as a non-market economy. Indonesia is proposed as the surrogate country.

- DOC allows interested parties to comment on the surrogate value within 30 days before the preliminary determination.

2.2. Countervailing Duty Investigation

- Period of Investigation: Calendar year 2024

- Alleged subsidy rate: Not specifically determined

- 26 subsidy programs under review, grouped into 7 major categories:

- Preferential lending (SOCBs, VDB, State Bank of Vietnam)

- Export/investment incentives

- Corporate income tax benefits (special zones, accelerated depreciation, etc.)

- Import tax exemptions (export manufacturing, industrial zones, FDI, etc.)

- Preferential land/water surface lease terms

- Provision of inputs/utilities at below-market prices

- Transnational subsidies: China’s control over veneer supply is alleged to indirectly affect input prices in Vietnam.

3. Investigation Process and Timeline

3.1. Roles of U.S. Agencies

- DOC: Determines the existence and extent of dumping and subsidization

- ITC: Assesses material injury to the U.S. domestic industry

==> Only if both agencies affirm dumping/subsidization and injury will duties be imposed.

3.2. DOC Proceedings

(1) Mandatory Respondent Selection

- DOC issued Quantity & Value (Q&V) questionnaires on June 11, 2024

- Response deadlines:

- CVD: June 25, 2025

- AD: Extended to July 2, 2025

- Based on responses and U.S. Customs data, DOC will select the two largest respondents to calculate individual margins.

- Due to different investigation periods (CVD: 2024; AD: Q4/2024–Q1/2025), selected respondents may differ between cases.

(2) Separate Rate Applications (AD only)

- Companies not selected as mandatory respondents must apply within 21 days from initiation to receive a separate AD rate.

- Failure to apply or obtain approval results in the application of the country-wide margin (the highest rate).

(3) Product Scope Comments

- Comment deadline: July 8, 2025

- Rebuttal deadline: July 18, 2025

(4) Investigation Questionnaires

- Sent to mandatory respondents and the Vietnamese government (for CVD cases)

- Response deadline: 30 days (extensions possible)

(5) Preliminary Determinations

- AD: October 29, 2025 (may be extended to December 18, 2025)

- CVD: August 15, 2025 (may be extended to October 20, 2025)

Note: DOC may apply 90-day retroactive duties if there is a finding of a surge in imports.

(6) On-site Verifications

- Following preliminary determinations, DOC may conduct verifications at selected companies and (in CVD cases) with the Vietnamese government.

(7) Final Determinations

- Scheduled: May 7, 2026 (extensions possible)

3.3. ITC Proceedings

- ITC evaluates whether the allegedly dumped/subsidized imports cause material injury to the U.S. industry.

- Historically, most cases conclude with a finding of injury.

To protect their legitimate interests, manufacturers and exporters should familiarize themselves with the procedure and actively contact Vietnamese law firms specializing in anti-dumping and trade remedy for timely assistance.

ASL Law is a leading full-service and independent Vietnamese law firm made up of experienced and talented lawyers. ASL Law is ranked as the top tier Law Firm in Vietnam by Legal500, Asia Law, WTR, and Asia Business Law Journal. Based in both Hanoi and Ho Chi Minh City in Vietnam, the firm’s main purpose is to provide the most practical, efficient and lawful advice to its domestic and international clients. If we can be of assistance, please email to [email protected].

ASL LAW is the top-tier Vietnam law firm for Anti-dumping & countervailing. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語