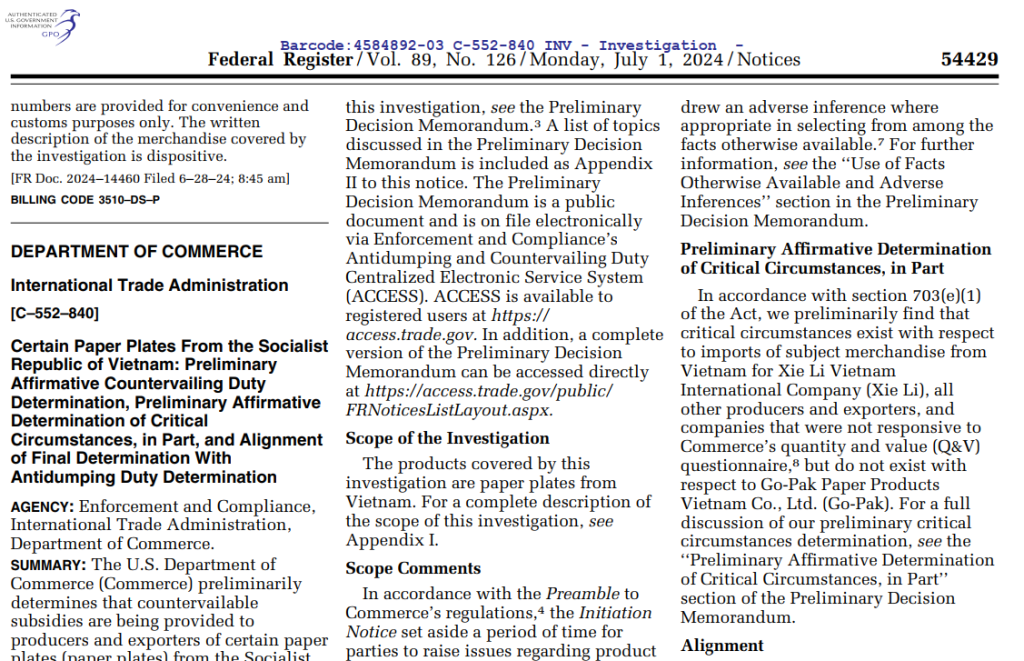

On June 25, 2024, the U.S. Department of Commerce (DOC) issued preliminary findings in the countervailing duty investigation on paper plates imported from Vietnam. This case was initiated by the DOC on February 14, 2024, following requests from U.S. paper plate manufacturers.

The investigated paper plates are classified under HS codes 4823.69.0040 or 4823.61.0040 and may be packaged with other products under HS codes 9505.90.4000 and 9505.90.6000.

In this investigation, the DOC selected two mandatory respondents. However, one mandatory respondent refused to participate, leaving only one mandatory respondent in this case.

According to the preliminary findings just released, the temporary countervailing duty rates are as follows:

- The only mandatory respondent in the case: 5.48%;

- Five non-cooperative companies (one mandatory respondent refusing to participate and four companies not responding to the Quantity and Value questionnaire): 237.65%, based on available data;

- Other Vietnamese companies: 5.48%, following the rate of the sole mandatory respondent.

This preliminary conclusion highlights the difference between companies that actively cooperate and those that do not, refusing to participate in the investigation and review. Therefore, companies subject to investigation should proactively contact reputable law firms specializing in anti-dumping and trade remedy to register as interested parties.

U.S. Customs and Border Protection (CBP) will require deposits on shipments exported to the U.S. at the temporary countervailing duty rates mentioned above starting July 1, 2024.

In the coming period, the DOC plans to conduct on-site verification to confirm the information provided by Vietnamese businesses. This verification is one of the bases for the DOC to issue its final conclusion and set the official duty rates for Vietnamese companies.

Interested parties may also submit comments on the case no later than seven days after the issuance of the final verification report. Rebuttals to comments from other parties must be submitted no later than five days after the comment submission deadline.

Subsequently, the DOC may hold a hearing upon request and is expected to issue the final determination by November 5, 2024, if there is no extension.

The DOC’s preliminary findings can be downloaded here.

ASL Law is a leading full-service and independent Vietnamese law firm made up of experienced and talented lawyers. ASL Law is ranked as the top tier Law Firm in Vietnam by Legal500, Asia Law, WTR, and Asia Business Law Journal. Based in both Hanoi and Ho Chi Minh City in Vietnam, the firm’s main purpose is to provide the most practical, efficient and lawful advice to its domestic and international clients. If we can be of assistance, please email to [email protected].

ASL LAW is the top-tier Vietnam law firm for Anti-dumping & countervailing. If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語