On May 22, 2025, the U.S. Department of Commerce (DOC) officially received a petition requesting the initiation of antidumping (AD) and countervailing duty (CVD) investigations on imports of decorative and hardwood plywood from China, Indonesia, and Vietnam. The petition was filed by the Coalition for Fair Trade in Hardwood Plywood, alleging that imports from these…

On May 23, 2025, the Canada Border Services Agency (CBSA) announced its determination in the anti-circumvention investigation concerning certain semi-trailer products imported from Vietnam. This represents an important step in clarifying transparency and compliance with international trade laws by Vietnamese exporting enterprises. According to the CBSA’s conclusion, the semi-trailer products imported from Vietnam show no…

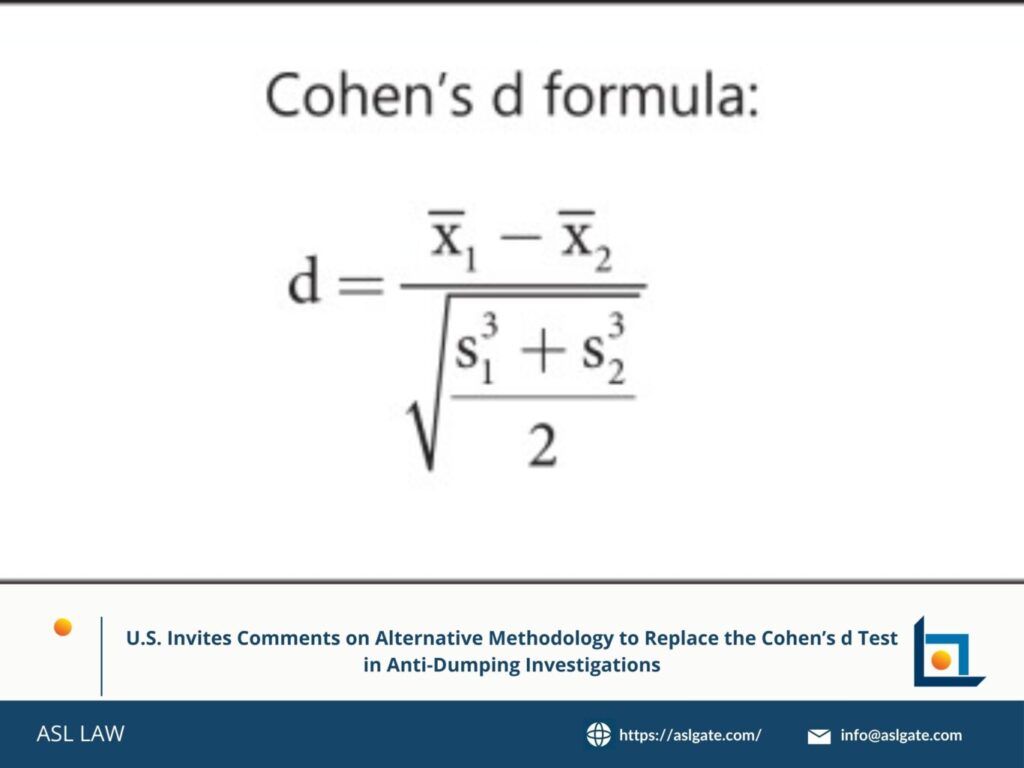

The U.S. Department of Commerce (DOC) has issued a notice seeking public input on potential alternatives to the Cohen’s d test, which has been used for over a decade in anti-dumping investigations. This initiative aims to comply with section 777A(d)(1)(B)(i) of the Tariff Act of 1930, as amended, which requires the DOC to determine whether…

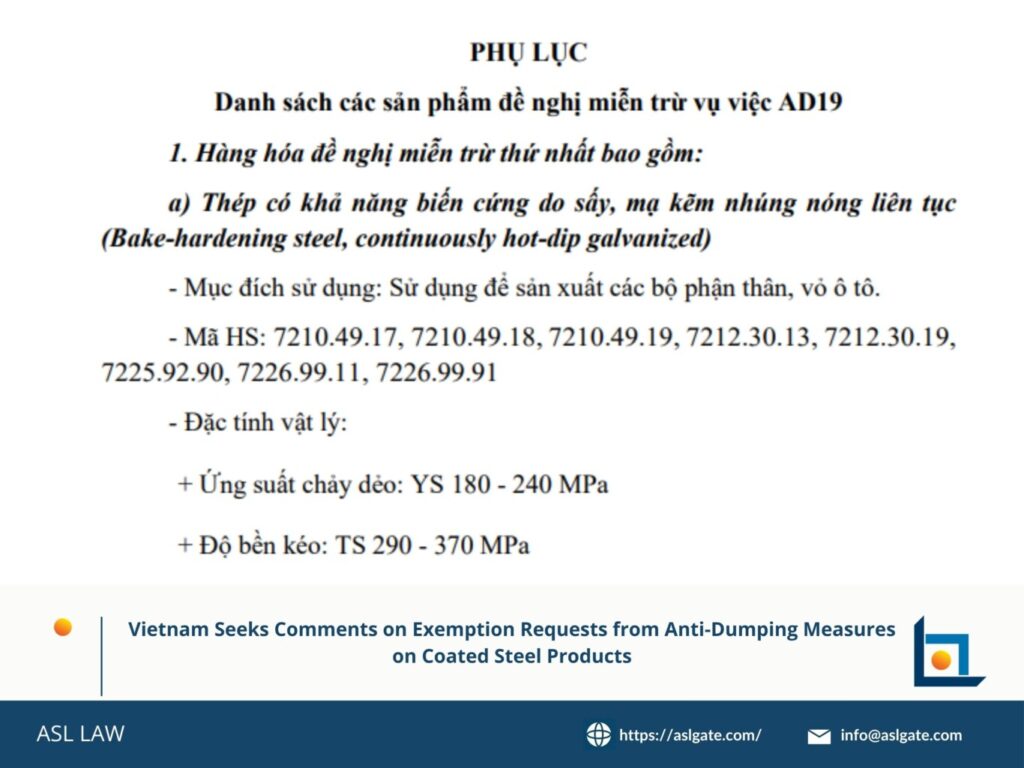

The Trade Remedies Authority of Vietnam (TRAV), under the Ministry of Industry and Trade, is currently accepting exemption requests from the application of anti-dumping measures on certain coated steel products subject to Decision No. 914/QD-BCT dated April 1, 2025, on the imposition of provisional anti-dumping duties on coated steel products originating from China and South…

The Trade Remedies Authority (TRA) of the United Kingdom recently announced adjustments to the list of developing countries granted exemptions and changes to the tariff quotas applied under the safeguard measures on certain steel products. The details are as follows: 1. Overview of the Safeguard Review On February 28, 2025, the TRA initiated a review…

The U.S. Department of Commerce (DOC) has recently issued its preliminary determination in the anti-dumping (AD) investigation concerning molded fiber products imported from Vietnam. 1. Case Background 2. DOC Preliminary Determination DOC has issued the following preliminary anti-dumping duty rates (net of countervailing duties): Comparison with China: Chinese exporters in the same case are subject…

Recently, the U.S. Department of Commerce (DOC) issued the final results of its administrative review concerning the alleged circumvention of anti-dumping and countervailing duties on rectangular steel pipe products imported from Vietnam. These products are subject to trade remedy duties when originating from China (Case Nos. A-570-914 and C-570-915). The review was initiated on October…

On February 21, 2025, the Ministry of Industry and Trade (MOIT) issued Decision No. 460/QĐ-BCT imposing provisional anti-dumping duties on hot-rolled coil (HRC) products originating from the Republic of India and the People’s Republic of China. Following this, on April 3, 2025, the Trade Remedies Authority of Vietnam (TRAV) held a public consultation to gather…

On May 12, 2025, the Canada Border Services Agency (CBSA) officially initiated an anti-dumping investigation into certain steel strapping products imported from multiple countries, including Vietnam. Product Under Investigation: Certain types of steel strapping classified under HS codes 7212.20, 7212.30, 7212.40, 7212.50, 7212.60, 7217.10, 7217.20, 7217.30, 7226.99, 7312.90, and 7326.20 (as detailed in the attached…

On April 3, 2025, the Trade Remedies Authority of Vietnam (TRAV) held a public consultation with relevant related parties to assess and determine the appropriate product scope within the framework of the anti-dumping investigation on hot rolled steel originating from India and China (Case Code: AD20). During the consultation, TRAV received various opinions from related…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語