“The global stability we once knew will not return anytime soon.”

– Singapore Prime Minister Lawrence Wong, April 4, 2025 (Channel News Asia)

In an era where nations prioritize domestic interests, escalate protectionist measures, and unilaterally impose tariffs, both Vietnamese enterprises and foreign direct investment (FDI) companies operating in Vietnam are confronting unprecedented legal challenges. This article systematically analyzes prominent legal risks and offers strategic recommendations from the perspective of a law firm specializing in international trade, foreign investment, and cross-border dispute resolution.

1. A New Era of Uncertainty – Vietnamese Enterprises and FDI Companies Cannot Remain Passive

The global landscape is shifting away from established norms. On April 4, 2025, Singapore’s Prime Minister Lawrence Wong candidly stated: “The global stability we once knew will not return anytime soon.” (Channel News Asia)

Concurrently, the United States announced a 46% tariff on most Vietnamese goods, marking one of the highest rates imposed on a non-China country. In 2024, Vietnam’s exports to the U.S. reached nearly $97 billion, underscoring the profound impact of such measures. (General Statistics Office of Vietnam)

If a resilient, internationally oriented economy like Singapore expresses concerns about being sidelined, a developing economy like Vietnam—with over $200 billion in exports to sensitive markets—must proactively prepare for emerging challenges.

2. Adapting Legal Strategies to Evolving Trade Dynamics

Legal departments and corporate counsel must transition from reactive roles to proactive strategists, anticipating risks within global trade networks. This entails not only interpreting laws but also analyzing geopolitical shifts, supply chain implications, and governmental behaviors in international commerce.

- Shift from International Law to National Interests: The World Trade Organization (WTO) is experiencing diminished effectiveness in dispute resolution; trade agreements such as ATIGA, RCEP, and CPTPP serve more as reference frameworks. In practice, tariff impositions and origin verifications are at the discretion of individual nations.

- ASEAN Nations Intensify Trade Defense Measures: Countries like Thailand, Malaysia, and Indonesia have initiated investigations and rejected Vietnamese goods suspected of origin fraud. Notably, in 2023, Thailand investigated yarn products, Malaysia scrutinized cold-rolled steel, and Indonesia examined chemical products from Vietnam. (Ministry of Industry and Trade Report)

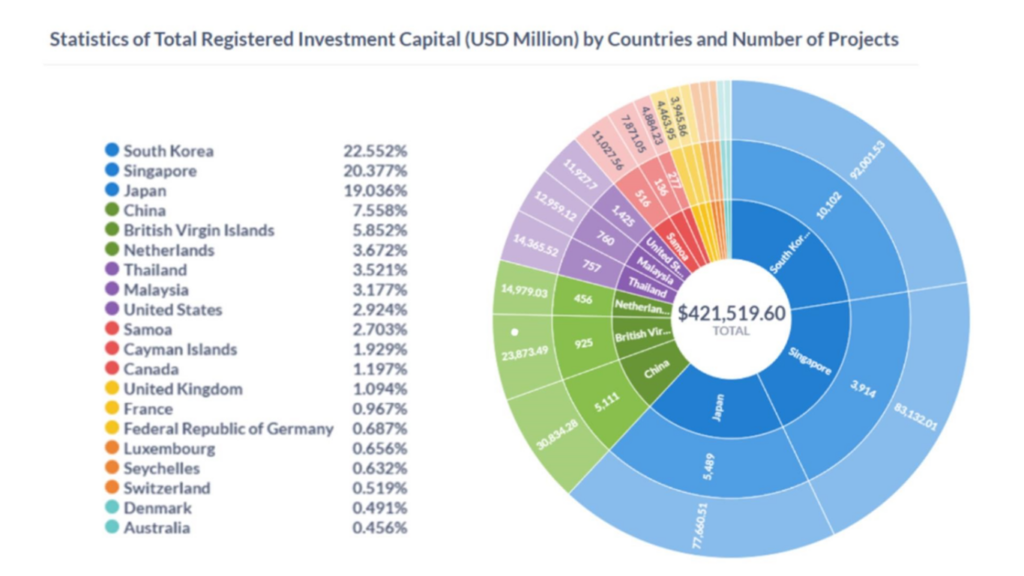

- Vietnam’s Role as a Supply Chain Intermediary: The influx of FDI, particularly from China, aiming to circumvent tariffs, places significant pressure on Vietnam’s origin verification systems.

3. Legal Risks Facing Vietnamese Enterprises and FDI Companies

A. For Vietnamese-Owned Domestic Enterprises

- Dependence on Chinese Inputs or Processing for FDI: Risk of being investigated as intermediaries for tariff evasion.

- Contractual Vulnerabilities: Potential lawsuits from international partners due to tariff-induced contract cancellations or compensation claims.

B. For FDI Enterprises, Especially Those from China

- Comprehensive Investigations: Scrutiny of ownership structures, technology, and control mechanisms—not limited to registration locations.

- Allegations of Intentional Production Relocation: Accusations of relocating manufacturing to Vietnam to evade tariffs, potentially leading to substantial duties.

C. Legal Disputes within ASEAN

- Stringent Origin Verification: Despite ATIGA, Vietnamese exports of agricultural products, chemicals, and construction materials to Thailand, Indonesia, and Malaysia face rigorous origin checks, especially when origin authenticity or pricing is questionable.

4. Implementing Back-to-Back Contracts and Demonstrating Genuine Value Addition

Back-to-Back Contracts: These agreements align terms between international clients and domestic suppliers, ensuring legal consistency and mitigating dispute risks, particularly during origin investigations.

Demonstrating Value Addition in Vietnam: Beyond labeling products as “Made in Vietnam,” companies must substantiate local value addition through:

- Production Processes: Detailed descriptions of manufacturing stages.

- Material Consumption Norms: Documentation of material usage rates.

- Accounting Records: Transparent financial documentation.

- Compliance with Origin Rules: Adherence to regulations outlined in Circular 05/2018/TT-BCT, RCEP, or CPTPP.

Failure to provide clear evidence may result in anti-circumvention tariffs similar to those imposed on Chinese products.

5. Proactive Measures for Enterprises to Mitigate Risks

1. Review and Update Contracts:

- Adjust Terms: Modify Incoterms, force majeure clauses, and tariff-related provisions.

- Specify Dispute Resolution Forums: Opt for arbitration centers like VIAC, SIAC, or HKIAC, with clear language and governing law specifications. Given the rapid changes in tariff measures, selecting arbitration bodies experienced in cross-border trade disputes and located in neutral jurisdictions is advisable.

Arbitration offers impartiality compared to domestic courts and effectively addresses disputes related to tariffs, origin verification, or contractual obligations affected by trade policy shifts. Additionally, clearly define the governing law (e.g., Singaporean or English law), appropriate language (English/Chinese/Vietnamese), and enforcement mechanisms in relevant jurisdictions.

2. Enhance Supply Chain Transparency:

- Implement Traceability Systems: Establish mechanisms to track product origins.

- Maintain Comprehensive Records: Keep detailed documentation to substantiate local content for origin investigations.

3. Prepare for Tariff Volatility:

- Renegotiate Contracts: Engage in discussions with U.S. partners, especially amid ongoing Vietnam-U.S. tariff negotiations.

- Develop Contingency Plans: Formulate strategies for scenarios involving tariff impositions, port detentions, or origin disputes.

4. For Upcoming or Future Contracts:

- Incorporate Tariff Adjustment Clauses: Include provisions for price adjustments or tariff risk-sharing.

- Mandate Origin Verification: Require clear origin documentation and outline procedures for investigations or sudden tariff changes.

- Establish Renegotiation Mechanisms: Define processes for contract renegotiation in response to significant trade policy shifts to avoid prolonged disputes.

- Include Confidentiality and Audit Clauses: Particularly important for sensitive goods involving FDI or complex origins.

- Specify Arbitration Details: Clearly state the arbitration institution, governing law, language, and enforcement locations.

5. Collaborate with Specialized Law Firms:

- Seek Ongoing Legal Counsel: Engage with law firms experienced in both domestic and international trade laws, particularly those with expertise in U.S., EU

ASL Law is a leading full-service and independent Vietnamese law firm made up of experienced and talented lawyers. ASL Law is ranked as the top tier Law Firm in Vietnam by Legal500, Asia Law, WTR, and Asia Business Law Journal. Based in both Hanoi and Ho Chi Minh City in Vietnam, the firm’s main purpose is to provide the most practical, efficient and lawful advice to its domestic and international clients. If we can be of assistance, please email to [email protected].

If you need any advice, please contact us for further information or collaboration.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語