To determine whether the USA 25% tariff on steel and aluminum qualifies as a safeguard duty under trade remedy measures, we must examine the concept of “safeguard duty” and the context of USA trade policies. What Is a Safeguard Duty? A safeguard duty is a temporary trade remedy measure imposed to restrict imports of a…

Effective March 12, 2025, all aluminum and steel imports into the USA will be subject to a 25% tariff, in line with the prior plan issued by President Donald Trump. The fact that the USA is adhering to this pre-established plan is noteworthy, as President Trump has previously delayed tariff impositions on other countries multiple…

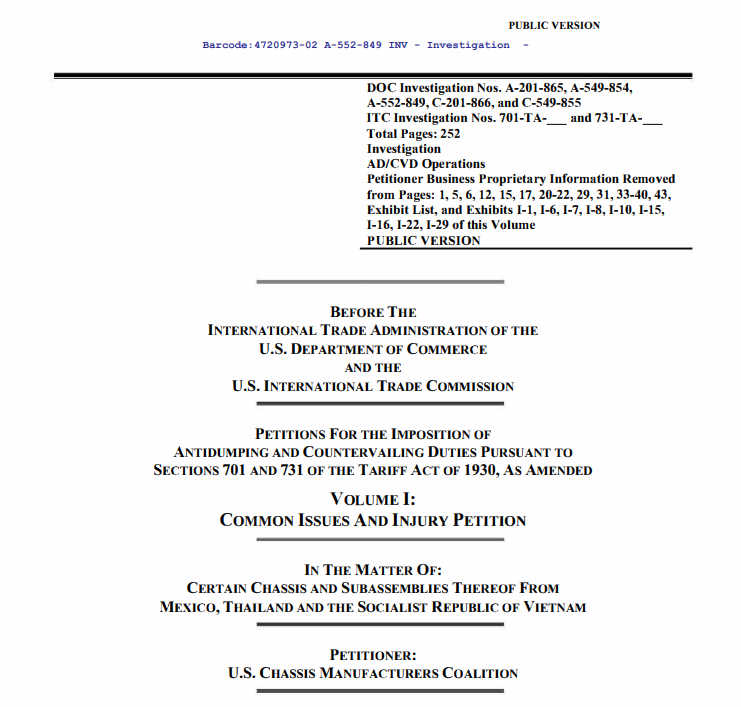

The USA Department of Commerce (DOC) has recently received a petition requesting an anti-dumping duty (ADD) investigation on semi-trailers and related assembly components imported from Vietnam, Mexico, and Thailand. Additionally, the USA is also considering a countervailing duty (CVD) investigation on imports from Mexico and Thailand. 1. Case Information 2. Investigation Process The investigation involves…

Vietnam is affected by USA trade policies but is not among the most heavily impacted countries in the 2025 global trade war. Recently, the Ministry of Industry and Trade (MOIT) issued an official statement acknowledging that USA tariff policies influence global trade flows; however, their impact on Vietnam remains moderate. In response, MOIT has coordinated…

Vietnam is actively considering issuing regulations on cryptocurrency management to ensure financial security and protect investors’ rights. Although cryptocurrencies have not been officially recognized, their increasing popularity has created an urgent need for a clear legal framework. The Current State of Cryptocurrency Usage in Vietnam According to data from cryptocurrency payment company Triple A, as…

According to many current workers, the personal income tax (PIT) family deduction in Vietnam has become outdated, failing to keep up with inflation and rising living costs, thus placing financial pressure on taxpayers. Currently, the deduction stands at VND 11 million per month (VND 132 million per year) for individuals and VND 4.4 million per…

Vietnam Social Insurance has submitted a proposal to the Ministry of Labor, Invalids, and Social Affairs, requesting a clear definition of bonuses, meal allowances, fuel costs, and other benefits that are not subject to mandatory social insurance contributions. The objective of this proposal is to ensure transparency and facilitate the social insurance collection process. In…

As President Trump signed the tariff order on March 3, the USA has officially imposed 10-25% tariffs on imports from its top three trading partners, effective March 4, as per President Trump’s plan in the previous few weeks. From midnight on March 4 (USA time), all goods from Mexico and Canada entering the USA are…

On February 21, 2025, the Ministry of Industry and Trade of Vietnam issued Decision No. 460/QĐ-BCT imposing a temporary anti-dumping duty on hot-rolled steel originating from India and China (case code: AD20). The hot-rolled steel products subject to the temporary anti-dumping duty from China are classified under the following HS codes: 7208.25.00, 7208.26.00, 7208.27.19, 7208.27.99,…

As Vietnamese businesses look beyond national borders to expand their operations, Thailand, Indonesia, Laos, Cambodia, and China emerge as strategic destinations for investment. These markets offer significant growth opportunities but also present unique legal landscapes that investors must navigate carefully. Following the success at the GC Summit 2024 event where ASL LAW presented on the…

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 日本語

日本語